For long-term investors, holding stocks from an index is usually the best choice. Ideally, dividend ones. But what if there is an even better and more efficient method?

In fact, according to some, there is an even better option - Long-term ownership of dividend blue-chips. And they show it in the numbers.

Over the past 50 years , dividend growthblue chipshave delivered about 13% annual returns and about 10% inflation-adjusted returns.

But that doesn't mean you can buy any old big dividend stock and hope to achieve unleveraged returns. Why? Because nearly half of all U.S. stocks turn into disasters.

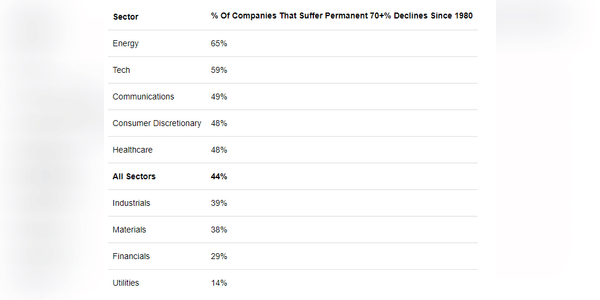

Since 1980, 44% of all US stocks have suffered sustained losses in excess of 70%. Those buses have had their wheels fall off, rolled into a ditch, and stayed there. Nearly 60% of technology stocks, a sector where change is rapid and constant, have been proven…