If you like investing in ETFs, you should definitely not just overlook this international ETF. It has even beaten the famous S&P500 index over the last 3 years. So let's take a look at why you shouldn't overlook it.

Today, we're going to look outside of the Americas, where a very special ETF caught my eye that might be a promising candidate for someone's portfolio. That ETF is the Pacer Developed Markets International Cash Cows 100 ETF $ICOW. The Pacer Developed Markets International Cash Cows 100 ETF (ICOW) is an exchange traded fund (ETF) that offers an attractive combination of capital appreciation and dividends. This ETF yields over 4% and has a three-year annualized total return of 19.2%, outperforming the SPDR S&P 500 ETF Trust $SPY. This article focuses on the key aspects of ICOW and its advantages over other ETFs in the market.

Fund structure and focus

ICOW invests in the 100 companies with the highest free cash flow yields in the FTSE Developed ex-US Index. The ETF has assets under management (AUM) of $543 million and an expense ratio of 0.65%. The focus on free cash flow and free cash flow yield differentiates the Cash Cow ETF from others. This strategy allows the fund to identify companies that generate cash efficiently and have the potential for growth and higher dividends.

Dividend yield

ICOW offers a dividend yield of 4.15%, which is attractive to investors seeking regular income from their investments, and this dividend yield also outperforms the yield of the $SPY ETF. The high dividend yield is a result of the focus on companies with high free cash flow yields that tend to pay higher dividends. This is mainly because these companies have a lot of excess cash, which they return to shareholders in the form of dividends.

This approach can be particularly beneficial in volatile or unpredictable market conditions, where regular dividend income can be crucial to successful investing.

Diversification and growth opportunities

The ETF invests in developed international markets, which allows for portfolio diversification and provides different growth opportunities. Investing in different geographies and sectors can reduce the risk of portfolio value loss due to regional or sector turbulence.

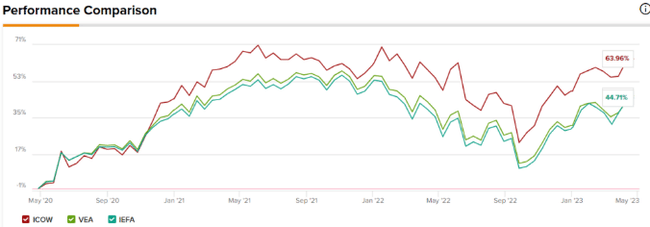

Over the past three years, popular larger international ETFs, such as the Vanguard FTSE Developed Markets ETF $VEA and the iShares Core MSCI EAFE ETF $IEFA, have outperformed in total return. This shows that ICOW's free cash flow yield-focused strategy can be successful in generating above-average returns.

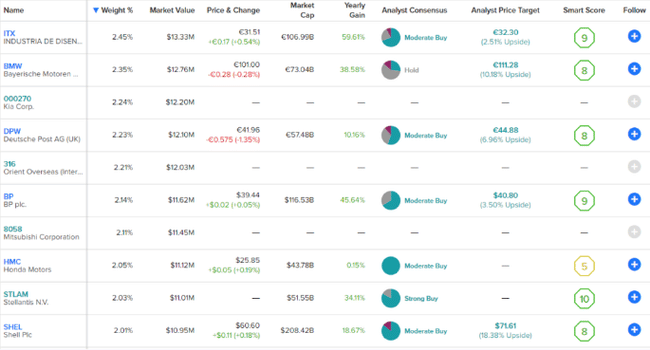

ICOW's top ten holdings account for 21.8% of the fund. Among them are European energy giants BP and Shell, and automakers like BMW, Kia, Honda and Stellantis. Industrials and energy are the largest sectors in which ICOW invests, with weights of 24.2% and 20.7%, respectively. This sector focus suggests that the fund seeks companies with high free cash flow yields across a variety of industries, contributing to portfolio diversification and potential for value growth.

Attractive valuations

The average price-to-earnings (P/E) ratio for ICOW is 4.6, which compares attractively to the average P/E ratios for IEFA (13.4) and the S&P 500 (24). The lower P/E ratio suggests that stocks in ICOW's portfolio are relatively cheaper than stocks in competing funds. This valuation may present an opportunity for investors seeking value in developed international markets. It is important to note that a low P/E ratio does not necessarily mean that a stock is undervalued, but may indicate that the market is not appreciating its potential for growth and higher dividends.

Conclusion

The Pacer Developed Markets International Cash Cows 100 ETF offers an attractive combination of capital appreciation and dividends for investors seeking diversification and growth opportunities in developed international markets. With a relatively low P/E ratio, strong performance and a focus on free cash flow and free cash flow yield, this fund sets itself apart from other ETFs in the market.

By investing in different sectors and geographies, investors can diversify their portfolio with ICOW and reduce the risk of losing value due to regional or sector turbulence. Although it has a higher expense ratio than some low-cost ETFs, its track record and attractive valuation make it an attractive option for investors.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

I think this is a quality ETF. Plus, it has a decent dividend, which is handy. I just don't know what to expect from such a high representation in industrials and energy going forward.