Feed

Which REITs do you have in your portfolio? Do you think this is finally the year they start to grow?

I looked at this year’s performance of the most well-known REITs, like $O or $VICI, and that growth isn’t bad at all. For example, shares of $O have risen by more than 14% since the start of the year. It’s possible these stocks will do well this year, but for me this sector is...

Read more

Undervalued sector?

The question of which sector is the most undervalued in the market today is coming up more and more often. After the strong rise in technology and AI, investors are starting to look at industries that have been outside the main spotlight, even though their fundamentals look solid. The first candidate is energy, which, despite very strong cash flows and stable...

Read more

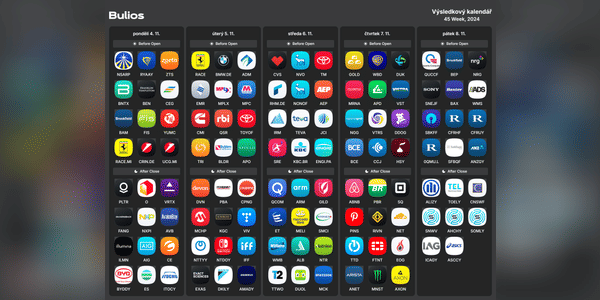

📅 This week's key market events!

Earnings season continues, especially in the technology and pharmaceutical sectors. Added to this are macro data that may stir market expectations for the next rate hike. Here's a round-up of the highlights:

🔵 Monday

Results before the markets open:

OnSemiconductor $ON - need to watch demand for chips in the automotive sector

Tyson Foods $TSN - price...

Read more

Zobrazit další komentáře

What do you think about REITs?

I had $O and $VICIin my portfolio last year and thought it was a great investment. However, towards the end of the year I sold all the REITs because they were underperforming and I wanted to move the money into more growth stocks. I think they are good dividend stocks for retirement though.

Zobrazit další komentáře

It may be fine for a stable portfolio, but I certainly won't be buying this stock.

📅 Investment outlook of the week!

This week we have corporate earnings across various sectors, the US Fed rate decision and new data from the economy.

📈 Monday

ISM Services PMI - Let's keep an eye on the health of the sector that makes up the majority of the US economy.

🔌 Results before the markets open:

ON Semiconductor $ON - A key player in the supply chain for the automotive and...

Read more

Zobrazit další komentáře

📅 This week's key events: Corporate results, macro data and tech dominance !📊

The new week brings earnings season in full swing, along with important economic indicators. Personally, I'll be focusing on the results Nvidia, Dell, HP a Salesforcewhile macro data like GDP per Q4 and data on PCE inflation will certainly be key to future market direction.

🍕Monday

Results before the...

Read more

Zobrazit další komentáře

We'll see how the $NVDA results come out tomorrow and how other stocks react.

Zobrazit další komentáře

Shares of $O and $VICI did not grow much last year, but $NVR did very well. I recently came across NVR REITs and I have to say I've been quite impressed with their performance. The company has been growing steadily and the stock is not as expensive as it used to be. I still want to do a more detailed analysis, but so far I find this stock quite attractive.

Zobrazit další komentáře

I'm not too keen on this sector, so I'm now focusing more on technology and growth stocks.

Zobrazit další komentáře

I have $O stock in my portfolio and I am very happy. The company pays a nice dividend, just the price isn't growing much right now.

Zobrazit další komentáře

Well $RACE had those results great, but due to the worse outlook the stock fell so I bought in😃

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Zobrazit další komentáře

In the end, therefore, a 0.5%cut in interest rates . I have to say that I was expecting only a 0.25% reduction. In my portfolio, I hope this will help mainly REITs ($O, $VICI) and maybe even $CVS.

What stocks in your portfolio have been, or will be, significantly (positively) impacted by the interest rate cut?

Zobrazit další komentáře

Shares of $MO have been rising nicely now and it looks like they will rise even more now that interest rates have been cut.

💼 Interesting dividend stocks! 💼

With the tension in the markets, dividend stocks are quite interesting to me. Here are 3 interesting companies that keep raising their dividend! 📈💡

🏭 National Storage Affiliates Trust $NSA

National Storage Affiliates Trust is a real estate investment trust (REIT) that specializes in managing storage facilities. With a portfolio of more than 1,052...

Read more

Zobrazit další komentáře

For a dividend investor, these are great stocks, and you shouldn’t expect their prices to rise by hundreds of percent.