Bill Combs

How many positions do you currently have in your portfolio? And what do you think is the ideal number?

For me, the ideal number of positions is up to 20 and I have 17 positions in my portfolio now. I plan to sell some positions partially or completely, so I will have room for more.

Zobrazit další komentáře

I've got 25 positions in my portfolio, but I'm going to want to reduce that. The ideal would be 20 positions.

Zobrazit další komentáře

ASML looks interesting and the business is great. I'll probably add their stock to my portfolio soon.

Zobrazit další komentáře

I'm thinking about buying it, as it's a great discount and an interesting opportunity.

Shares of $BTI and $MO formed new ATH today. Both stocks are up over 25% year to date and also pay a dividend of over 7%. I had both $BTI and $MOin my portfolio until the beginning of the summer . I sold $BTI and kept $MO as I trust Altria and don't need more than $BTI and two tobacco stocks in my portfolio.

What about you? Do you prefer $BTI or $MO and why?

...Read more

Zobrazit další komentáře

They're not doing too well, but I've bought the stock. If the stock goes down, I'd still buy.

Zobrazit další komentáře

I like LMT, but I already thought it was expensive last year when the stock hit a new high, so I didn't go for it. Well, now it's even higher😅

Zobrazit další komentáře

I don't invest in Czech stocks, but Komerčka seems like a good choice. I would be afraid to invest in CEZ, I would not want to fight the government for it.

Zobrazit další komentáře

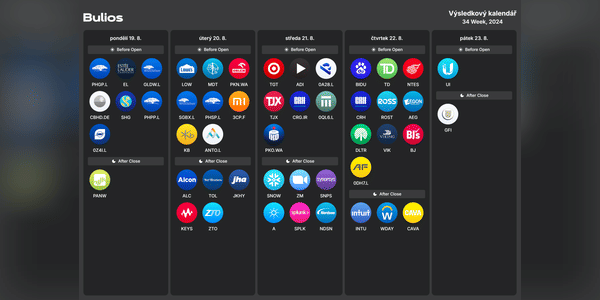

I'm curious about $TGT and then how the construction sector will do, I'd quite like to find a company at an interesting price if it's not too late, because with the gradual lowering of rates and next year, there could be more building again thanks to cheaper money.

Zobrazit další komentáře

Shares of $WBD are still falling and I honestly don't know how to approach this stock. I have a small position as I see potential there and believe the company could do well, but on the other hand, I don't have much to back me up like stock trends, results or profitability.

How do you approach $WBDstock ?

Zobrazit další komentáře

I see it pretty pale here too, I'm just there on speculation and dilution because I bought stupid earlier and now I'm just hoping the price gets to $9 and running away from it.

Does anyone have $MDTstock in their portfolio ?

I was quite intrigued by Medtronic a couple of years ago as they are in an important sector, the business is nicely built and what they are doing makes sense to me long term and I can see the potential, but I'm interested in the opinion of others.

Zobrazit další komentáře

I don't know the company at all and overall this sector is quite complicated for me, although I would like to have a representative. So I wonder if anyone will know. According to the long term chart, it looks like it has found its bottom around $70 since falling from their highs and could be turning around. I don't know the numbers though, nothing, so I don't know ...😊

Now the price is right at the important= threshold of $150 per share. If we look lower today, I'll take some intraday trade, but everything will depend on inflation.