Bill Combs

What do you think about the decline in $AAPLstock this year ? Are you buying or selling?

Shares of $AAPL are down more than 10% in the past month. The main reason for the decline was investors' reaction to news of a significant drop in iPhone sales in China. It seems to me that Apple has the least potential out of the "Magnificent 7", so I'll just hold the stock for now.

Zobrazit další komentáře

I'm very curious how the DOJ's Google lawsuit will turn out, if they block those Apple payments for the search page they will lose about 20% of their net profit which they didn't have to put any effort into and I would say it will also reduce their overall margins.

Shares of American Airlines fell about 8% yesterday after earnings, mainly due to a lower outlook for this year. I wasn't that impressed with $AAL, but lately it seems like the sector is starting to recover. I find $UAL and $DAL the best so far, but their share price is not too low again.

What do you think about the results of $AAL?

Zobrazit další komentáře

I have $RYAAY from this sector. It takes a slightly different approach than other companies. I wouldn't go to another one.

Procter & Gamble also reported results today. The results were quite good, the company is planning $6 billion worth of buybacks this year, and overall it is clear that the company is doing well. I use their products a lot, but the stock is too defensive for me and I don't see that much potential with it.

Does anyone have $PGstock in their portfolio?

Zobrazit další komentáře

The price is currently very high, so I would wait to buy. I prefer to buy AMD now.

Zobrazit další komentáře

These companies are really doing well and the performance is great. If $0M6I.L would get below $23, I would start buying.

Zobrazit další komentáře

Do you have any stocks in your portfolio that are not too dependent on economic cycles?

In my portfolio it would definitely be $WMstocks , as garbage is always being exported. Plus, the chart shows nicely that the various crises in the past have not affected this stock much. The other stock will probably be $MO, since people are always smoking whether interest rates are low or...

Read more

Zobrazit další komentáře

Altria is great for me, it's perfect for adding to your portfolio and the dividend is very high.

What do you think about the recent news of a possible Intel acquisition?

After the news of a possible acquisition of Intel by an anonymous company, $INTCstock is up 9%. If that were to happen, I think it could only help Intel. But my opinion is still the same and I wouldn't buy $INTC stock.

Zobrazit další komentáře

Even if that happens, I still think it's an uninteresting and risky investment. Intel simply won't catch up with its competition anymore.

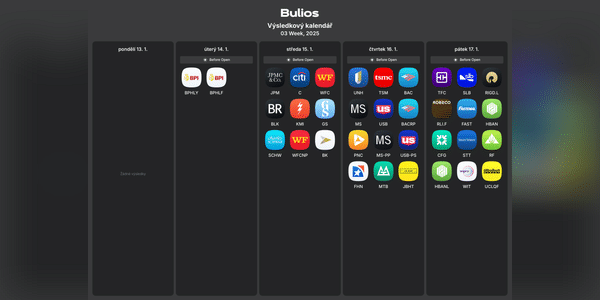

In the end, the results of the big banks turned out very well - almost all items exceeded expectations. I have $BACstock in my portfolio and was recently intrigued by @m wise_investor' s article on the City, so I bought $C at the beginning of the year and am very happy so far.

Which bank stocks do you have in your portfolio?

Zobrazit další komentáře

I have a few years of $JPM stock in my portfolio and that's good enough for now. Overall financial sector stocks are very expensive right now.

As far as defensive stocks are concerned, it's not just $PEP and $KOthat are falling now , but also $NESM.DE. Nestlé shares have lost more than 20% over the past year, yet the company is not doing badly financially at all. I don't buy defensive stocks much, but $PEP or $NESM.DE are at interesting prices right now.

What's your take on $NESM.DEstock ?

Zobrazit další komentáře

The drop there is really significant, but I've been looking more at $PEP stock lately, as the price is really low there right now.

How is the arms industry represented in your portfolio?

I'm still watching $LMTstock and starting to seriously consider buying it. I think the company has a great business, the current price is quite low and the P/E is not exorbitant. In addition, Donald Trump has a fairly positive relationship with the sector, and his potential actions could help these companies grow.

Zobrazit další komentáře

Last year, $ENR.DE was one of the best performing stocks in Europe. This German company did not fare well in 2023, but last year the company recovered and the stock rose by 300%. I honestly don't like this sector at all, but this company is quite interesting. However, the stock is pretty overvalued right now.

Anyone have shares of $ENR.DE in their portfolio or on a watchlist?

Zobrazit další komentáře

I'm not very focused on energy and if I had to choose something, I would shop in the US and not Europe.

Investors, which stock do you consider the riskiest in your portfolio?

For me, it's definitely $BABA and $CAVA. For Alibaba, I see the main risk in China itself and the way the state there operates, and for CAVA I see a lot of potential but also a lot of question marks that can change a lot of things negatively.

Zobrazit další komentáře

Much more important will be how inflation in the US turns out today. Otherwise, I want to look at the $TSM results tomorrow

Yesterday's Delta Air Lines results were very positive, with shares up 9%. Revenues and earnings beat expectations and strong earnings are expected for 2025 (more in Flash News). I don't own stocks from this sector, but clearly this sector is starting to recover and companies are starting to do well.

Do you have $DAL or any other airlinestocks in your portfolio ?

Zobrazit další komentáře

Companies are starting to do well now and it doesn't look bad, it could still be a good opportunity to establish a position.

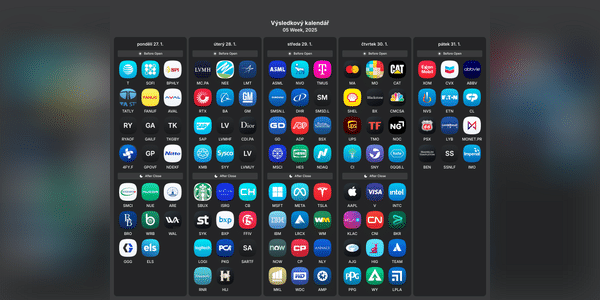

The $TSLA and $NVO will certainly be interesting, but Wednesday's Fed rate decision will be the most important.