Bill Combs

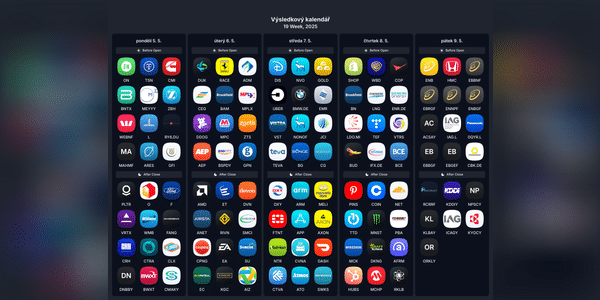

As for the results, this week will probably be more interesting for me than the last one. A number of companies whose shares I hold in my portfolio will report results, and I expect bigger moves because they are growth stocks. I will be watching the results of $PLTR, $NVO, $AMD and $TTD.

Which companies' results will you be interested in?

Zobrazit další komentáře

I'll be most interested in the results of $NVO now, as I already have a large position and hope the stock bounces off the bottom.

What do you think about the growth of $CVSstock ?

The stock is up more than 50% since the beginning of the year and it is clear that it is doing well again after a long time. I sold the stock at a loss last year. Of course, it's not pleasant to see them rise after I sold them, but I still don't like the fundamentals and I won't be buying the stock again.

Apple's results may have exceeded expectations, but I don't feel good about it. Tariffs are gradually starting to be reflected in the results and growth is slowing. I still hold $AAPLstock in my portfolio, but I sold some of it last week and moved the money into other stocks.

Does Apple still look like an interesting investment to you?

Zobrazit další komentáře

I think it's expensive right now and I'm definitely not going to shop around. I think $GOOG is better for me now.

Do you have any broker stocks in your portfolio?

I've been looking at different brokerage firms and their stocks recently, and I've been surprised at how strongly they've been rising. For example, $IBKR or $XTB.WAhas been a very solid performer . $HOOD is also interesting . I'm adding $XTB.WA to my watchlist right now and would happily buy at a lower price.

Zobrazit další komentáře

Overall, Polish stocks are very interesting and have a lot of potential, so I'm adding $XTB.WA to my watchlist as well.

I haven't had many interesting companies on my watchlist in the last couple of months, but recently ON Semiconductor caught my eye. It makes chips for automakers like Tesla, GM, Hyundai, Ford and VW. While it's not in an ideal situation right now and its results aren't great, it has quite a bit of potential and the stock is cheap right now.

What's your take on $ON?

Zobrazit další komentáře

I've been looking at this company, but so far I'm only investing in this industry through Tesla.

Zobrazit další komentáře

I don't have one in my portfolio at night and I only invest once. If I wanted to invest regularly, I would choose SP500.

Have you ever been affected by the FOMO effect? If so, in which investment or stock?

I got influenced by it in the beginning mainly in $NKE and $CVS. I did what everyone else was doing and was afraid of being left behind - which was a mistake. But I've taken a different approach over the last year, and I'm trying to be guided mostly by facts, not sentiment.

Zobrazit další komentáře

It will probably affect everybody to some extent, but it's important to really look at the fundamentals and the numbers.

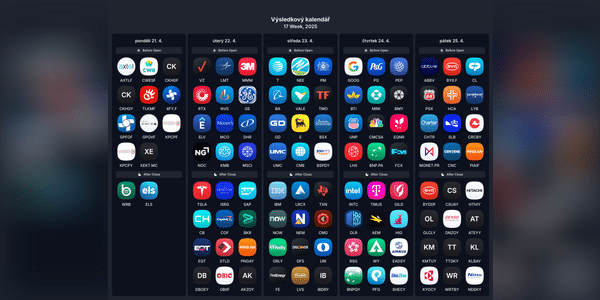

What do you think of Intel's results? Does anyone else have $INTCstock in their portfolio?

I think the results were not too bad, but the company is still not doing well (detailed info is in flash news). I never had$INTC stock in my portfolio and I would definitely not invest in this company now.

Zobrazit další komentáře

I'm staying out of it and I'm just gonna watch it. In the end, the new CEO isn't changing much yet.

Do you have tobacco company stocks in your portfolio?

These dividend stocks are doing quite well this year, as $MO, $BTI and $PM are up more than 10% since the beginning of the year. Last year I had $MO in my portfolio and was very happy, but this year I sold the dividend stocks and bought growth stocks.

Zobrazit další komentáře

I don't have dividend stocks in my portfolio, but if I had to make a decision and pick something it would be $MO.

What do you think of Tesla's results?

The results missed expectations and almost all items posted a loss. Still, $TSLAstock is up 5% in the after market, ostensibly due to Musk announcing that he'll be pulling out of DOGE next month to focus more on Tesla. I've already bought the stock this year and have pretty mixed feelings about these results.

Zobrazit další komentáře

I am definitely not changing my mind and will still hold the stock. But Robotax will help the company a lot.

Shares of BlackRock, the world's largest investment asset manager, have already fallen more than 16% since the start of the year, which is not very common for such a firm. Overall, I find financial sector stocks cheap right now and see this as an interesting opportunity.

Are you buying shares of $BLK? Do you have any stocks from this sector on your watchlist right now?

Zobrazit další komentáře

The growth of $HTZstock continues unabated. The stock is up 136% in the last month alone, which is pretty solid for a car rental company. The news of Pershing Square's large stake in Hertz is behind the growth. I won't be investing in it anymore, but other car rental companies may be interesting.

What do you think ofthis growth in $HTZstock ?

Zobrazit další komentáře

It's extremely expensive now and I definitely wouldn't invest in it and a correction needs to come soon.

It's starting to get pretty exciting and this week is going to be very interesting in terms of results. For me, the most important results will definitely be $TSLA, $GOOG and $INTC. If the stock continues to fall, I'll be overbought.

Which companies' results will you be interested in? And what stocks are you planning to buy?

I also lightly shop all the time, but I confess I still stay away from celery. I don't know, I just see it all as too much of a "comedy" where one says A, then B, then it's refuted, back to A, and the markets react to everything but actually in a time frame of six months I don't dare to guess if we're in growth or decline. Technology and AI are still holding the market because there is a hunger for chips, but those tariffs can really put a lot of pressure on consumers and who knows what then. 🤷♂️

The last few weeks I've just been adding $GOOG $AMZN $NVDA. I see, as with you Luky, one more time then $TTD was mentioned here, I'm looking at info and a digital marketing company, which is definitely a trend too, but isn't there a lot of competition in this? What makes the company interesting to you?

Otherwise cash I still hold probably quite a bit, around 20% but as I said I don't really believe Trump has stopped "swirling the waters".