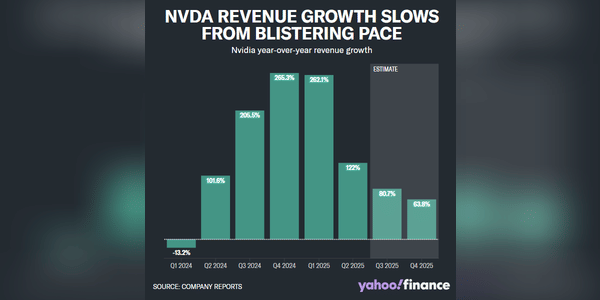

Nvidia's $NVDA-7.4%growth metrics aren't impressing Wall Street as much as they used to. Can you imagine the reaction if the company had missed some of its earnings estimates?

Do you still hold shares of $NVDA-7.4%?

Nvidia's $NVDA-7.4%growth metrics aren't impressing Wall Street as much as they used to. Can you imagine the reaction if the company had missed some of its earnings estimates?

Do you still hold shares of $NVDA-7.4%?

How much of your portfolio do you have, or do you consider it reasonable to have in precious metals (gold, silver...)?

Do you have any of these in your portfolio at all?

I don't currently have anything like that in my portfolio. I'll probably include gold in my portfolio, but when I'm older, as it doesn't make much sense to me now, given the look of it.

Anyone interested in Canon stock?

I came across an interesting report today. Canon is planning to hit the high-end device market by launching its new nanoimprint technology as part of the technology rivalry between the US and China...

A few years back I had a little something there, but I sold it for a loss because it looked like a value trap. Canon didn't make much money on photo equipment, the lithographic equipment was a step behind ASML and could only compete with Nikon. Most of their income comes from printers and that may be a declining business over time (I see it mentioned in almost every HPQ analysis).

What I understand so far is that their machine is based on a completely different principle than the EUV from ASMl and the process is more time consuming, so the efficiency/costs are not fully ideal and especially it is not yet proven in series production. If it turns out that it really can do 4nm technology in sufficient quality and price, it may change the balance of power in ASML's monopoly position, but I think we are still far from that.

Anyway, I think that even if the lithography does take off, it won't be an advantage for them over ASML in terms of being able to supply China with the technology to make advanced semiconductors. They will get the same restrictions from the US as anyone else.

Intel said it plans to spin off its programmable chip unit and make an initial public offering within two to three years. I don't really know how to view this news, positive or negative? The $INTC-11.5% stock initially weakened today but is already going back into the black.

I really like Intel and Gelsinger's vision, so I believe this will move Intel a little closer to achieving their goal.

The best-performing S&P 500 stock so far in 2023:

Nvidia $NVDA-7.4% +231.9% Facebook $META-5.1% +146.3% Tesla $TSLA-10.4% +98.9% Royal Caribbean $RCL-5.8% +97.7% Carnival $CCL-4.6% +95.2% PulteGroup $PHM3.5% +81.5% General Electric $GE-11.1% +74.7% Palo Alto $PANW-7.0% +73.9% West Pharma $WST-7.6% +73.2% AMD $AMD-8.6% +69% Adobe $ADBE-5.0% +67.4% Salesforce $CRM-5.7% +67.1% Lam Research $LRCX-9.4% +67% Amazon $AMZN-4.2% +64.4%.

Were you able to...

Read more

Unfortunately, neither, but I did manage to buy at least $AAPL-7.3% and $GOOGL-3.4% shares.

US economic growth was revised lower in the second quarter to a still solid pace, but momentum appears to have picked up at the start of the third quarter as consumer spending is supported by a tight labour market.

U.S. gross domestic product expanded at an annualized rate of 2.1 percent in the second quarter, the government said today in its second estimate of GDP for the three...

Read more

Hi investors, how many trades do you make on average per year? And a question, has it historically paid off for you to be more active or more passive in finding new opportunities?

Or better said - Which method has been more effective for you?

Quite often I find that investors try too hard and look for a quantum of companies, yet only a handful of them would suffice if they were...

Read more

Exactly, just a few quality stocks. I don't do that many trades a year. I make the bare minimum of trades. I mostly just buy and buy because I'm investing for the long term.

Did you buy any stocks this week?

I bought $39 worth of Pfizer $PFE-5.3% stock and did a little research on their future intentions, where I clearly see growth potential + a regular and stable dividend. What about you?

Thanks for the report. I hadn't thought about buying shares in this company, but the company looks interesting. However, I think I like $MC.PA-1.5% stock better.

Not long ago, everyone here was worried about REITs and the real estate market, but somehow that topic has died down. Anyway, I have and continue to hold $O-3.3% stock with peace of mind, which incidentally announced another increase in its monthly dividend to $0.2555 per share, for an annual amount of $3.066 per share. This is the 121st monthly dividend increase for the common...

Read more

Has anyone checked the performance against SPY? Yield including dividends for 1y,3y,5y,10y (1.45%, 19.5%, 50%, 124%) vs. SPY including dividends (18.55%, 50.6%, 71.8%, 223%)

"Sell the energy companies, oil prices will go down."

I've been hearing this phrase since last year, when oil was described as unsustainable. In the meantime, my stocks are still nicely in the black and oil prices are rising sharply AGAIN today after Saudi Arabia pledged major production cuts in July while the Organization of Petroleum Exporting Countries and allies agreed to...

Read more

It depends on reserves and production. It's all in the hands of Opceu, and that's why I prefer to stay out of it.

It's official! President Joe Biden on Saturday signed a bill that suspends the U.S.'s $31.4 trillion national debt ceiling, preventing the first-ever sovereign default just two days before it was threatened.

The House of Representatives and Senate passed the legislation during the week after Biden and House Speaker Kevin McCarthy reached an agreement after tense negotiations.

The...

Read more

I agree with the others here. It is a paradox that markets are rising. After all, it can't go on like this indefinitely and sooner or later it will burst anyway.

Good morning, everyone. Today, I would like to share with you the stock(s) that I will include in my portfolio today. It will be Target $TGT1.5%, the second largest discount chain in the US after Walmart.

I agree, it's definitely an interesting opportunity and the price, it's already really nice.

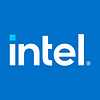

We've made incredible strides in technology over the last couple of decades, and overall the progress is phenomenal. I remember just a few years ago we were talking about AI as the future and now we're figuring out where to put the money to ride its wave. But what's next, over the horizon with AI? What will be the next top technology that will be a total gamechanger?

When I see it in the chart, it's clear to me. This is how it has to be. From another point of view, it's great what we've done as humanity, but where our civilization is going is sad...

More good news! The IPO market is reviving.

Citigroup has cancelled the $7 billion sale of its Mexican consumer unit known as Banamex and plans to launch an IPO instead. The IPO is expected to be completed in 2025, the company said. Citi is considering a dual listing of the stock, possibly in Mexico City and New York.

Well, there are not many new IPOs yet, or I don't hear about it anywhere. It might be getting going, I'd like to see new companies.

I'm still holding and will continue to hold. It's just a small position, I don't have any mega profit there, so I'll wait😃