Disney $DIS reported results yesterday after the market closed!

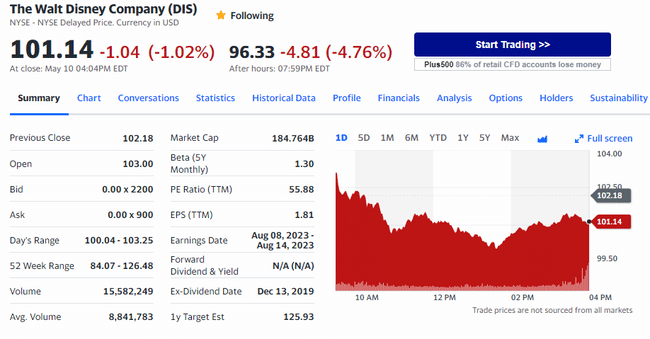

In the aftermarket, Disney is down more than 4.5%

Earnings per share were down one cent (-0.34%)

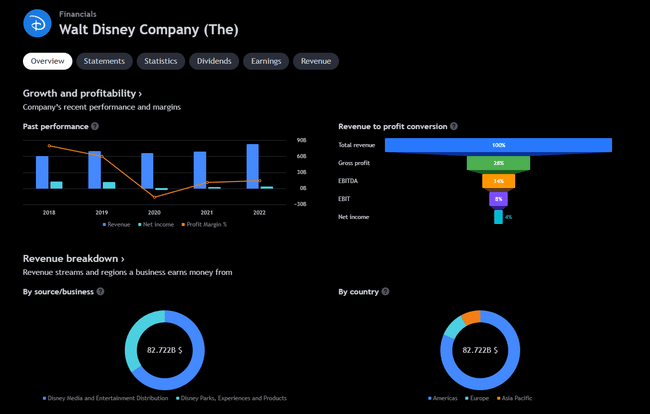

Revenue, on the other hand, was $20M higher than the expected $21.759B

The company reported lower losses from its Disney+ streaming service due to cost-cutting measures.

Despite this, the service did not earn what was expected. In fact, it recently raised prices.

On the other hand, theme parks that used to be closed during the cover-up are producing solid profits ($2.17B)

Disney is 50% away from the peak and is holding on to support around where the stock fell in the 2020 cover.

It's been a year since Disney has been in a sideways trend. This may be a good price to buy the position.

This colossus probably won't end overnight, but it's still important to keep an eye out and develop a solid analysis.

However, the company's P/E is high at 55 and that can easily discourage many.

After the recent change in management, we have to hope that the company will be back in the limelight.

I was expecting better results, but it's already a pretty nice price to buy.