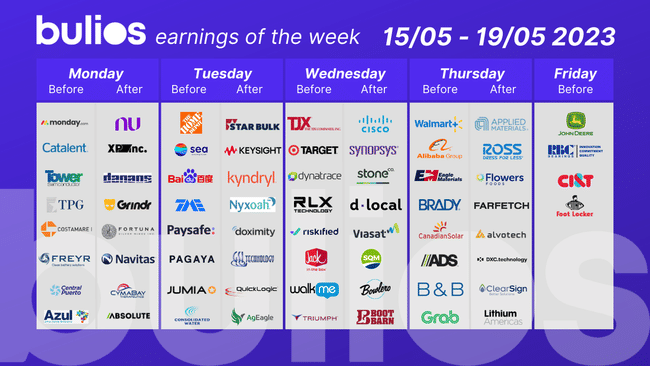

Another week, more results! You don't have to worry at all that we won't have anything to follow, as next week sees another series of interesting names reporting their results. For my part, I'm taking Nu Holdings $NU, Home Depot $HD, Cisco $CSCO, Walmart $WMT, Alibaba $BABA and Deere & Company $DE as the most attractive.

What do analysts expect from these companies?

Nu Holdings $NU

NU's earnings for the quarter are expected to be positively impacted by operating efficiencies. The Zacks Consensus Estimate for revenue in the currently reported quarter is set at $1.51 billion, suggesting a 4% quarter-over-quarter growth, while earnings per share is expected to meet estimates but possibly stagnate (not expected to beat estimates).

Home Depot $HD

This retailer is expected to post quarterly earnings of $3.83 per share in its upcoming report, representing a year-over-year change of -6.4%. Revenue is expected to be $38.63 billion, down 0.7% from the previous quarter.

Cisco $CSCO

Cisco is expected to post quarterly earnings at $0.97 per share in its upcoming report, representing a year-over-year change of +11.5%. Revenue is expected to be $14.39 billion, up 12.1% from the previous quarter.

Walmart $WMT

In its upcoming report, Walmart is expected to post quarterly earnings of $1.30 per share, which represents no change from the previous quarter. Revenue is expected to be $148.62 billion, up 5% from the previous quarter.

Alibaba $BABA

Alibaba is expected to report EPS of $1.30, up 4% from the previous quarter. Meanwhile, Zacks projects net sales of $30.87 billion, down 4.1% from a year ago period.

Deere & Company $DE

This agricultural equipment maker is expected to post quarterly earnings of $8.51 per share in its upcoming report, representing a year-over-year change of +25%. Revenue is expected to be $14.78 billion, up 22.8% from the previous quarter.

Foot Locker $FL

FL is expected to post quarterly earnings at $0.79 per share in its upcoming report, representing a year-over-year change of -50.6%. Revenue is expected to be $2 billion, down 8.3% from the previous quarter.

- Whose results do you care about? Let me know in the comments!

Walmart and Target 😎

I will be very interested in $WMT and $DE 😉👍

I would love to buy a Deere, but seeing the estimates, I guess it won't work out 😪