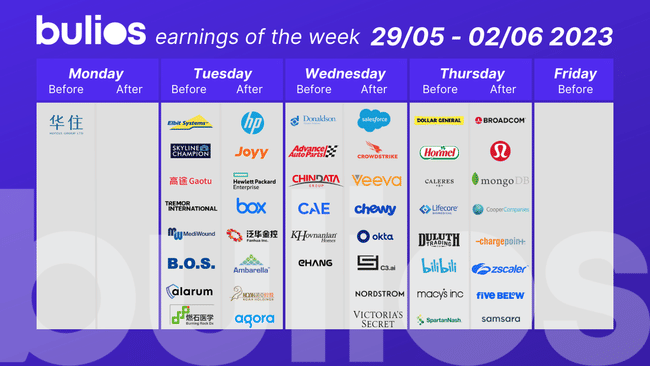

Next week does not look interesting at first glance in terms of quarterly results, but the opposite is true. Investors can look forward to quarterly results from HP $HPQ, Salesforce $CRM, Crowdstrike $CRWD, Victoria's Secret $VSCO, C3.ai $AI, Dollar General $DG and Broadcom $AVGO.

What do analysts expect from these companies?

HP $HPQ

This maker of personal computers and printers is expected to post quarterly earnings of $0.76 per share in its upcoming report, representing a year-over-year change of -29.6%. Revenue is expected to be $13.07 billion, down 20.7% from the previous quarter.

Salesforce $CRM

Salesforce is expected to report earnings of $1.61 per share, up 64.29% year-over-year. Meanwhile, the latest consensus estimate expects revenue of $8.17 billion, up 10.24% from the previous quarter.

Looking at the full year, Zacks Consensus Estimates suggest that analysts are expecting earnings of $7.11 per share and revenue of $34.62 billion. These totals would represent changes of +35.69% and +10.43% from a year ago.

Crowdstrike $CRWD

CrowdStrike Holdings was expected to report earnings of $0.50 per share, which would represent a year-over-year growth of 61.29%. Meanwhile, the latest consensus estimate projects revenue of $674.33 million, up 38.23% from the previous quarter.

Victoria's Secret $VSCO

VSCO is expected to post quarterly earnings at $0.54 per share in its upcoming report, representing a year-over-year change of -51.4%. Revenue is expected to be $1.42 billion, down 4.2% from the previous quarter.

C3.ai $AI

This company is expected to report a quarterly loss of $0.17 per share in its upcoming report, representing a year-over-year change of +19.1%. Revenue is expected to be $71.18 million, down 1.6% from the previous quarter.

Dollar General $DG

Dollar General is expected to post quarterly earnings at $2.38 per share in its upcoming report, representing a year-over-year change of -1.2%. Revenue is expected to be $9.47 billion, up 8.2% from the previous quarter.

Broadcom $AVGO

Broadcom Inc. is expected to report earnings of $10.13 per share, up 11.69% year-over-year. Meanwhile, the Zacks Consensus Estimate for earnings projects net sales of $8.71 billion, up 7.5% from the previous year.

- Whose results do you care about? Let me know in the comments!

I'll check out $HPQ out of curiosity, but any results next week shouldn't affect me in any way. So hopefully it will be more relaxed.

I'll be happy to take a look at HP and Salesforce. Otherwise, it's thinning out and we only have a few companies left to close out the $SPY earnings season. Quite a positive surprise...

I'll definitely be interested in the $HPQ results.

I'm curious about the C3 AI. I'm really interested to see what percentage the stock stops at.

Crowdstrike and Broadcom, I'm holding both. So I'm clear.