A little cold Friday shower...

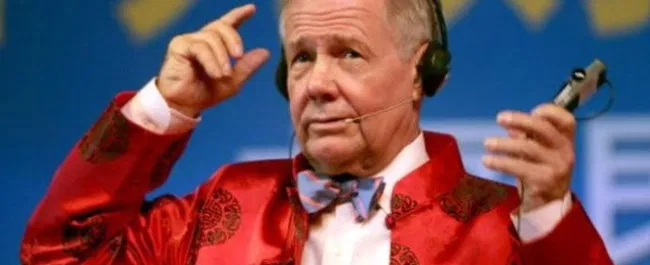

Market legend Jim Rogers: I'm expecting the worst bear trend of my career.

Famed investor Jim Rogers is bracing for the roughest bear market he's ever seen. Rates are expected to stay higher for longer, the deck chair is rocking under the U.S. dollar and commodities should continue to be an interesting investment going forward, he told Real Vision.

What was said in the Real Vision interview, among other things?

1. The next bear trend will be the worst I've ever seen. This is due to debt, which has grown at a rocketing rate over the past 14 years. Even the 2008 crisis was triggered by large debts, but they were fractions compared to the current ones.

2. I keep worrying about what the politicians (in Washington, in this case possibly because of the debt ceiling, but this is a long term issue) will show again. I think they have no idea what they should be doing.

3. Many countries are looking for an alternative to the US dollar. Partly because of the significant US debt, partly after the experience of using the US currency as a geopolitical weapon (against Russia). I expect something to go wrong in the FX market within 2-3 years.

4. Rates will still have to rise to put out the inflationary fire. The world has never seen such debt and "money printing" as in recent years. It will (have to) hurt a lot before the problems are resolved.

5. All markets will have problems - stock, bond, real estate, currency, in short, all of them. If you want to manage this within your portfolio, you should understand what a downside bet is, but more importantly, what good cash is for.

6. I don't think the world is going to switch to bitcoin. We will work with digital money to the maximum extent, but it will be money controlled by governments.

7. The best investment protection against inflation is real assets. And real assets are especially commodities. I still don't see a cheaper investment than commodities.

For me, the most interesting concerns are about the US dollar - it plays into my "pro cryptocurrency" notes :)

There are always certain people who are terribly optimistic and equally negative, and occasionally some people get it right, but as we all know, even Warren Buffet doesn't know if the markets are going to go up, down, right, left, or spin in circles. :P

It doesn't look like much at the moment, but it may just be the calm before the storm. If the market goes to new lows, it will be the biggest global event in years.

I agree with virtually all of your points, my biggest concern is the USD situation. Cash is good to hold if it really crashes, it will be a goldmine for people who have cash.

[I don't think the world is going to switch to bitcoin.]

Let's re-examine this a couple more bank collapses down the line.

It might as well be, the debt is insane and they keep going further and further before they hit it.

Oh no! Anyway... 😂

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Not good 😬

That's really a shower, hopefully it won't be though the truth of it is pretty much no. And especially point 3 kinda scares me too, the way they just keep raising the debt ceiling over and over again and the money printing just keeps on going. And as stated, an awful lot of money has been printed over the last few years and one day the consequences of that will come and then it will be a mess.