So, as expected, we have a pause in the rate hikes!

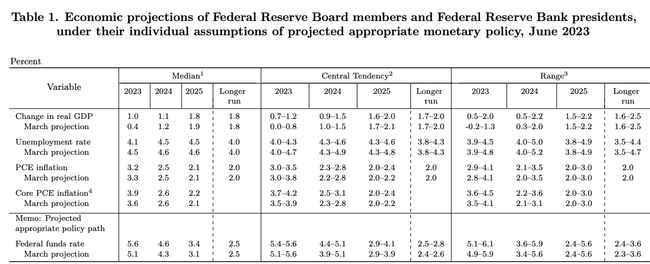

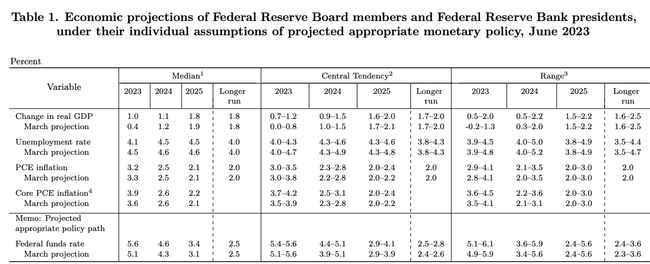

However, Jerome Powell and the Fed now expect the Fed Funds rate to be 50 basis points higher than the current level at the end of this year.

What do you think?

So, as expected, we have a pause in the rate hikes!

However, Jerome Powell and the Fed now expect the Fed Funds rate to be 50 basis points higher than the current level at the end of this year.

What do you think?

They are doing well there and want to avoid the mistakes of the past. If it was like that everywhere, it would be good.

They should take inspiration from the next lift here, but they should have done it 7 months ago...

If the rate is expected to be higher at the end of the year, that should cool the market and it will come out on the side. You can see the probabilities here

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

For me, it looks quite friendly and above expectations "rosy" :)

I was expecting something like this, but I don't think it has scared the markets too much yet...

Well, probably as expected...The market is reacting accordingly and we'll see what the press release is in a minute.

Look, I guess I'm not even surprised. I was expecting a pause and some sort of reminder that the cycle of increases may not be over yet.