A little while ago I came across an interesting interview with Timur Barotov, an analyst at BH Securities.

Four reasons why stock markets are due for another correction:

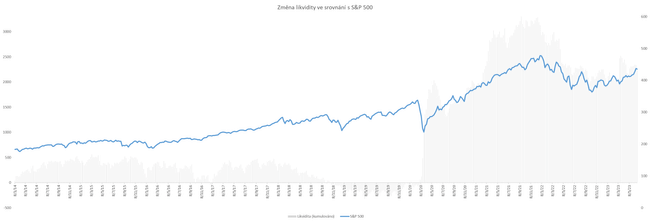

1. Liquidity

Changes in liquidity (money in circulation) in the U.S. economy perfectly predict the stock markets since the pandemic began (see chart below). The rise in the stock markets after the sharp decline in March 2020 was accompanied by the printing of $5 trillion by the U.S. Federal Reserve. Three trillion was printed quickly in early 2020 and the remaining $2 trillion was gradually injected into the system over the next 2 years.

It wasn't until the first half of 2022 that the Fed committed to quantitative tightening due to runaway inflation. Since then, the US central bank has been reducing its balance sheet by about USD 90 billion per month. Although this balance sheet reduction has actually been taking place since the beginning of this year, the US government has released around half a trillion USD in fiscal policy over the same period. Combined with the USD 400 billion that the Fed reprinted in March 2023 in response to the banking crisis, this has created the breeding ground for stock market euphoria.

But further liquidity developments are likely to be unfavourable for markets. The US Treasury needs to grow to more than $1 trillion by the end of September, according to analysts, and the Fed is likely to continue quantitative tightening. Thus, for the first time since the pandemic, both institutions (the US government and the Fed) will simultaneously withdraw liquidity from circulation.

If the Treasury coffers are largely filled with funds from the reverse repo market, which currently holds around USD 2 trillion, then this might not affect equity markets. However, the more hawkish the Fed's rhetoric becomes, the less money will leave this reverse repo market and the more money will potentially flow out of the equity markets.

2. The yield curve

The US Treasury yield curve has historically been one of the best forward looking indicators of recession. In practice, the spread (yield spread) in yields between 10-year and 2-year bonds, or between 10-year and 3-month bonds, is used. Both show essentially the same thing. This curve has predicted every US recession since 1979 and now predicts the next one. The important thing about it, however, is that it can help with the timing of economic conditions and thus the stock markets.

A rising spread (i.e., a deepening of the curve into negative territory) has not historically been correlated with a fall in the stock markets. Thus, the curve entering negative territory was not in itself a threat to equity markets. It is only its re-inversion, or the narrowing of the spread and subsequent rise back into higher, positive territory that correlates with economic distress.

The explanation for this phenomenon is that yield curve re-inversion has historically been associated with rising unemployment, a phase of acute economic distress for businesses and consumers. And stock markets have typically reacted negatively to this. Unemployment is thus a key variable that determines the onset of recessions and cyclical movements in stock markets.

At the moment, this curve is almost at its bottom, and therefore shows no sign of a re-inversion, which could come at any time. This is consistent with the fact that unemployment in the United States is still at record lows and shows no signs of rising yet.

3. The rate hike cycle

To some, the current optimism in equity markets in light of rising rates may seem like an exception. But history shows that this is no exception. Rises in key US interest rates have usually been accompanied by a rise in equity markets. Somewhat ironically, it's only the lowering of these rates that has often correlated with declines. The reason for this is simply the reactive (not proactive) nature of interest rate movements. Markets have seen rate cuts, usually only when things were bad.

We are currently at, or approaching, the peak in US interest rates, which are likely to stay with us for a while. So a possible cut in those rates is not on the agenda anytime soon. It will only be when rising unemployment forces the Fed to cut rates. Indeed, if it fails to do so, the rise in unemployment could continue and the economy could end up in a depression.

4. A slowing economy

This monetary cycle is confusing and exceptional for many investors. This is due to the fact that the economy is seemingly not slowing down in light of record rising interest rates, and has even shown signs of expansion since early 2023 (due to seasonal effects). Parts of the stock markets are euphoric and corporate profits have not yet fallen dramatically. As a result, optimism about the future economic development is emerging and the case for a bull market is gaining psychological strength.

Against this background, however, the US economy is gradually weakening and running out of breath. The effect of the rise in interest rates is very slowly but surely permeating the economy and discouraging consumers and businesses from making new investments, new loans and overall economic expansion. Given the amount of newly printed money over the last 3 years, the effects of interest rates are largely being absorbed by these funds.

It should be noted, however, that both companies and consumers are running out of savings and the full effects of interest rates are being written into the economy with a lag of up to two years. In other words, we do not seem to be at the end of the monetary cycle (as its length might suggest), but rather in the middle.

Equity markets have begun much of this cycle during 2022 in what has been described as "the most anticipated recession of all time". The S&P 500 index corrected 20%, the Nasdaq Composite 30% and the Dow Jones nearly 10%. As the economy has performed well so far this year, some of that appreciation has erased in varying degrees depending on sectors.

Psychologically, it now seems difficult to make a bearish argument. This is because investor psychology over the medium term may determine stock prices significantly more than fundamentals. But in my view, fundamentals are not supporting the current rally, or are supporting it only temporarily. This is evidenced by the lower allocation and vigilance of institutional investors at present. In an uncertain environment such as the current one, the optimal strategy is to diversify capital into different macroeconomic scenarios.

The liquidity thing may have been forgotten too quickly, that's a good point.