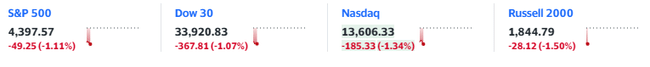

So, today in the sign of red. 🔴

Stocks fell after better-than-expected jobs data raised investor concerns about the state of the economy and the path of interest rates.

Private-sector jobs rose by 497,000 in June, according to payroll processing firm ADP, the biggest monthly increase since July 2022. June's increase was more than double the Dow Jones consensus estimate.

This of course supports inflation - an interest rate hike is likely on the table.

Well, I certainly didn't expect such a move. Here you can see how many investors are counting on interest rate hikes, not many.

It looks like we won't avoid a recession after all.

Thanks for the info, I was kind of expecting it today, because even last month the unemployment numbers weren't exactly great and just the inflation is still scary. Well, the market is strong, but it's probably a reaction already to the Fed raising those interest rates again.

Thanks for the info, I was wondering what was going on today.