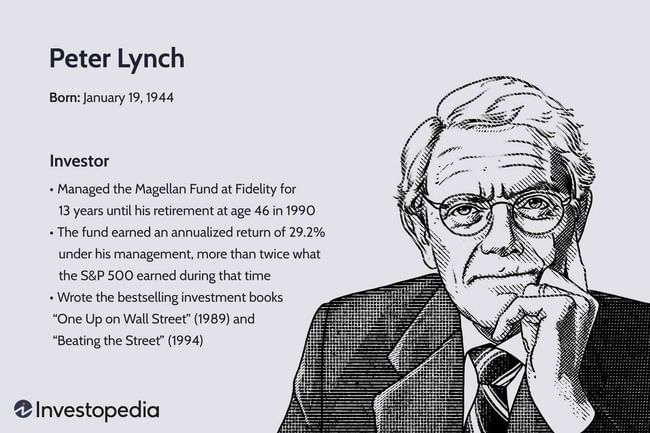

Peter Lynch, a famous and successful investor, a legend in the world of investing, what are his views that he stands by and should every investor know and follow? :)

1Know what you own: It is important to understand what you own and be able to explain it simply.

2People often own stocks without knowing about the company: Many investors own stock without knowing what the company does or what its story is.

3. Don't just buy for price growth: investors should have a better reason for buying a stock than just price growth.

4. Ordinary companies can be profitable: Investing in ordinary, well-known companies like Coca-Cola or Walmart can be a good investment.

5. Don't be fooled by the company name: Sometimes an attractive company name, such as "Student Loan Marketing," can be misleading.

6. Learn about the company: It is important to have information about the company and its story in order to make a good investment.

7. Don't make accurate predictions about the economy: Predicting the economy, interest rates and stock market trends is useless.

8. The stock market is volatile: The stock market is full of ups and downs, and you need to account for that and not sell in fear.

9. Concerns about the economy: regardless of the economic situation, investment opportunities can be found.

10. Focus on factual information: it is important to monitor factual information about companies, such as stock levels, raw material prices, etc.

11. Don't listen to predictions about the future: Don't give too much weight to predictions about the future as they are often inaccurate.

12. Get rid of the illusion of limited possibilities: stocks have no upper or lower limit, they can move in any direction.

13. Don't waste time watching the economy: A large amount of time spent watching the economy is usually unnecessary.

14. Focus on medium-term results: instead of predicting the future, focus on the medium-term results of companies.

14 - I totally agree with this and I would say that too many investors are clinging to a distant future that is unclear to everyone anyway. And I need to work on 12 myself. 😁

7,9,11 and 13 - he probably spent a lot of time on it before he came to the conclusion that it was pretty useless. In my own way, I'm slowly discovering probably the same thing. But trying to predict the future is so tempting. 🤔