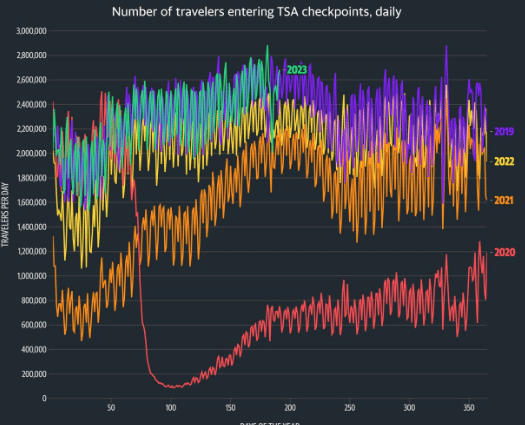

Investors, I came across an interesting chart today.

It looks like people from the US are starting to use air travel more and more and that means airlines could do well and I think next Q airline results will be very solid.

Top US airline stocks :

Airline stocks are volatile, but I certainly wouldn't say it's a bad investment.

I have been looking at $DAL and I have to say that I quite like this company and plan to take a closer look at it.

In addition, yesterday $DAL reported their Q results which were very solid ( I posted on DAL status results yesterday ).

How do you view these companies and do you have any stocks from this sector included in your portfolio?

I've been holding $DAL and $AAL since the covid bottom, it was basically the beginning of my investing, because I thought that companies like that can't fail... :) So I'm making nice profits on my positions right now, and if we beat the pre-covid highs, that'll be awesome... :)