Why (not) rush into US stocks right now... ?

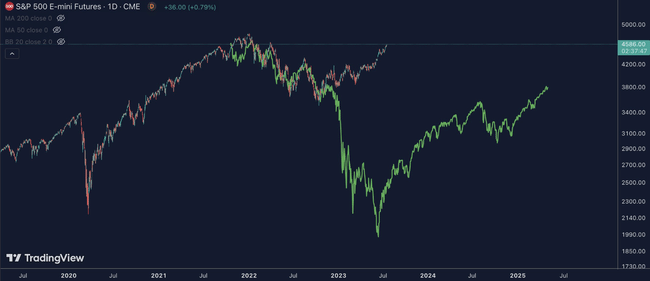

US equity indices are not far from all-time highs, which from a bearish perspective suggests room for a correction at least in the short term. However, the bulls believe that the upward momentum has not yet run out and are betting on further growth. The situation is not clear-cut and a wrong decision could cost investors dearly.

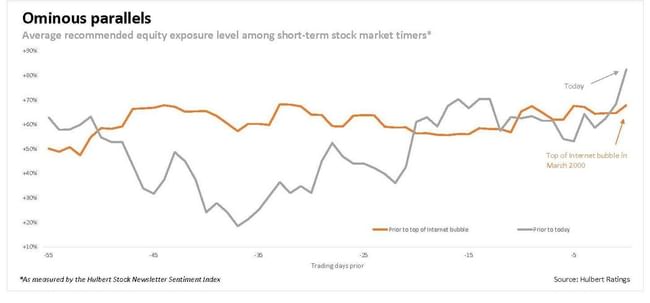

Mark Hulbert, founder of Hulbert Financial Digest, points out that while last year in mid-October most stock newsletters strongly discouraged investors from strengthening stock positions, the situation is now reversed. Investors are being urged to significantly increase their exposure to stocks. The extremely bullish mood in the market prevails even though the S&P 500 index alone has added nearly 19% since the beginning of the year and the tech-heavy Nasdaq Composite roughly 37%.

Hulbert warns against unbridled optimism, even suggesting that the current market developments, fuelled by the boom in generative artificial intelligence, bear a striking resemblance to what happened just before the tech bubble burst more than 20 years ago.

Bulls believe that stocks are headed higher, or that any correction will be only mild, creating an opportunity to strengthen equity positions at better prices. Conversely, the view among bears is that the growth of recent months is unsustainable and markets are in for a period of deep declines.

The next weeks or months will bring a resolution, but in any case investors face a difficult question of how to proceed. By being (overly) optimistic, they risk deep losses; by being (overly) cautious, they risk getting off the gravy train prematurely.

Let's add a few more charts that illustrate where the US stock market currently stands.

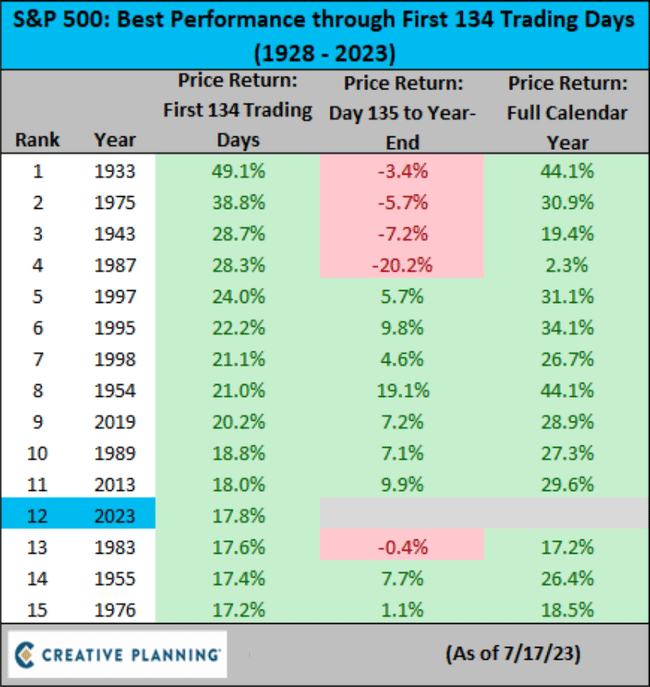

So far this year, the S&P 500 Index has been very successful, adding almost 19%. After Monday's session, it was slightly less, and at the time it was the twelfth best year-to-date performance in history. There has never been a time when the index has ended a calendar year in the red after such a strong run through mid-July, although it was far from it in 1987.

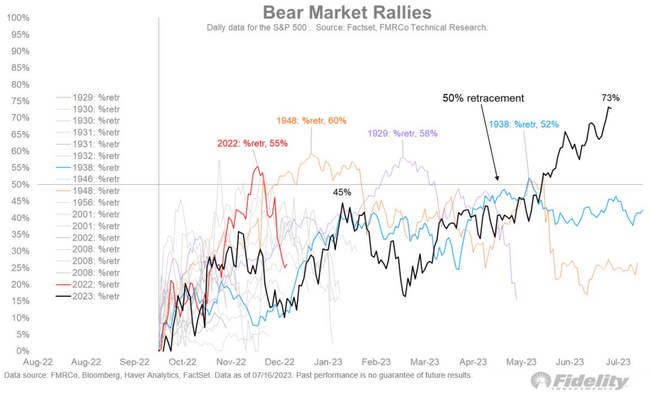

The S&P 500 has already recovered three-quarters of the losses it took during the bear trend. Meanwhile, normal "bear rallies" rarely result in a return above 50% of the previous high. Significant rises from the bottom of a downtrend are usually already the start of a rise to new highs.

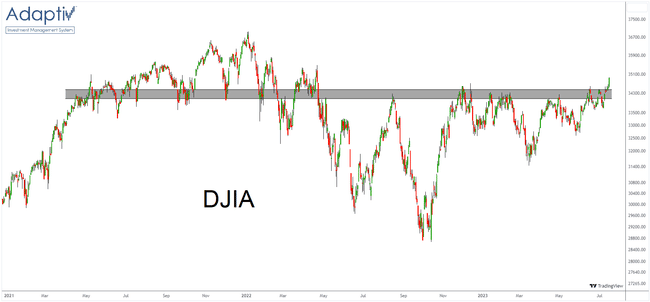

The Dow has also climbed to new highs (not just this year, but even since April 2022) in recent days.

In any case, the market has very emphatically let us forget the similarity with 2008. A new wave of share price falls has not yet taken place, despite tighter monetary policy.

Great, nice post. I'd be careful now too, I definitely don't buy tech stocks anymore, but I do buy ETFs and dividend stocks. However, I'm more likely to wait and gradually send cash to the broker to be prepared. If the tech stocks would fall, I would definitely appreciate it and overbought😁.

Nice post, charts. I'll join the view that to "reduce" the concern I agree, the index are not very balanced and the growth is due to a few units, max dozens of companies. But I would definitely be cautious and try to be sort of in the middle. Rather watch the tech sector now and not rush into it, but again not be afraid to buy quietly elsewhere where things aren't so hot yet. 😊 But it's true that we all like technology because when it takes off, that's where the growth is the most dramatic.

There are many sectors that are still in correction.

But we need to take into account how many stocks are dragging down that index performance. Not every stock has scored hundreds of percent YTD, so I wouldn't be pessimistic about buying.