The problem of "micro" investing

Hello investors here, what is your view on this topic?

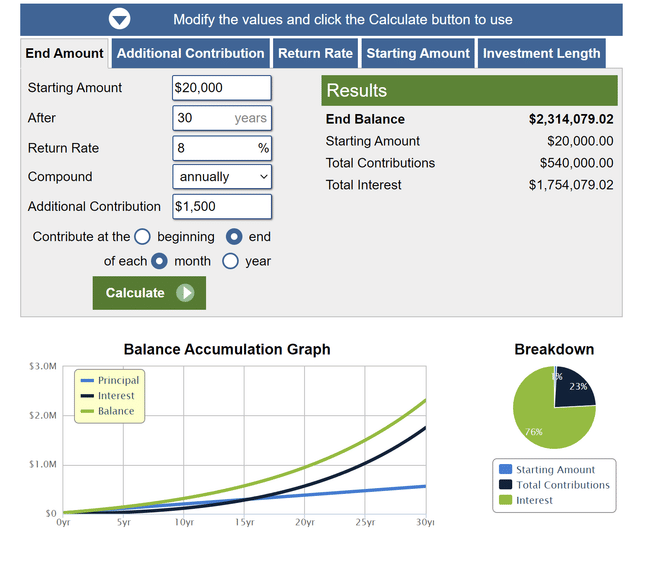

Let's take an average Czech citizen who would like to invest, but his capital is not big and he wants to put aside 1000-2000 per month in his investments. He sends it to the SNP ETF and doesn't worry about anything, let's assume that the index manages to appreciate quite nicely and return 8% in a year. His initial deposit was 20,000. (All in CZK, the calculator shows $, let's not worry about that)

The question is, does it even make sense for such a person? Yes, he will certainly get more out of his money than in a regular savings account, etc. But wouldn't it make sense for a person who has, say, a 30 year horizon free to invest, to take this relatively modest amount and spend 10 years trying to increase his income to invest larger amounts? Either by starting a business or looking for extra income.

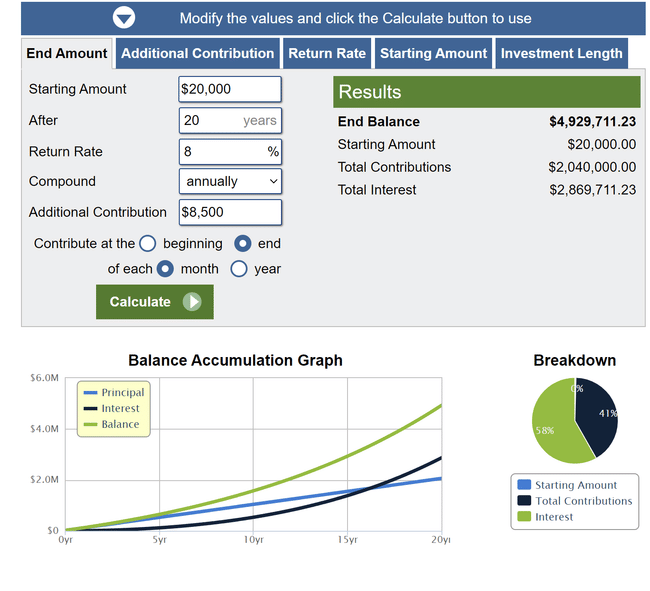

If he succeeded in doing this, after those 10 years his investment plan might look like this:

Where I don't think even the 8,500CZK is somehow a staggeringly large amount of money, but I'm opting for more conservative numbers.

His return would be more than double that. What is your opinion on this? Is it worth investing at all if one would like to put away these lower amounts? I'm thinking about it, since this is the method that Radovan Vávra heavily promoted two years ago, and I personally think it's fine for the average person to at least look into investing for lower amounts, but it doesn't seem like a reasonable solution either. What do you think?

But here's the big problem - this view of investing is very limited. We all have rising incomes over the course of our lives, and unless one is an idiot who lets everything go, one's income will increase by that inflation in the long run. This means that he is able to put away a little more each year than the year before - which he should be doing. If he sets it up that way, then the result is different.

The same is then true of volatility. These charts and calculators don't take it into account at all - it takes 8% per year of that particular portion increasing all the time. But the reality is that stocks, of all things, will write off 15% one year only to add 30% the next. It's just that those regular purchases are then volatile through that as well and can often change that return significantly.

As for trying to increase your income - yes, it's certainly a great idea. However, the main problem here is that not everyone can do it. These charts and calculators are meant to try to convince and educate the average Popeye who will simply never be rich - that instead of saving into a retirement cushion (which was quite OK in the gold standard era), he should invest. I know intimately the reality of CR bank branches myself, and in terms of investment, people's lack of confidence and - and this is the stumbling block - their incomes and budgets - it's simply a tragedy. Even the 1,000 a month for investment is a luxury for a retail mass market. It's all the more unfortunate that bank investment advice is able to rush even 20-somethings into funds where 90% of the conservative majority are government bonds...

I was just thinking, it's not completely out of the question, you just have to realize what you want. For example, I want my own little apartment. So today it would take about 10mil. How much it will be in 30 years no one knows, but the assumption is that basically the price will go with inflation and therefore it will be the equivalent of today's 10mil. So using this calculator, you have to set the first deposit to come out to 10mil and then increase each subsequent deposit by inflation. That might work then. It would take some checking, I'm writing off the top of my head. Is there a mathematician here who could clarify this? Or is there a calculator somewhere that takes into account regular deposit increases and inflation?

Option 2 would be great, assuming the person in question could implement that option. It's not fun to start your own business. In our republic, it also depends a lot on whether the person in question has children. It is still true that we have for example one of the biggest Pay gap in Europe (the difference in salary between woman and man) and for women between 30-40 to have a better job and more income is not fun to get even nowadays :) so it is then sometimes easier and "more safe" option 1

I still think these are solid numbers and it will also depend on the individual's risk tolerance if they have a shorter investment horizon and "lower" amounts available.

The problem I always have with these 30-year outlooks is that nobody answers the question. Okay, but what's it gonna buy me in 30 years? Do you really think that in 30 years, a few million will be enough to provide the top-notch health care I need? So an education applicable anywhere in the world, basic. Owning your own business (or at least self-employed) a continuation. Investing living money is a luxury. So the goal is not to make x million in x years but to maintain the highest possible income on an ongoing basis. And to increase the investment continuously. So for me, if anything, option 2. 👍

For me, definitely worth it. Perhaps there is always money to be saved somewhere. Contribution 540k. and 1.75mil in interest... I think that's a nice ratio. The sooner you start, the better. Of course, life isn't all about money, and you have to enjoy yourself... You have to find a balance.