Today, we take a look at a leader in the coffee industry where it's definitely not just about coffee anymore. Everybody, even non-coffee drinkers like me, know this giant and mainly because it has marketing that we just see everywhere and especially young people like it.

$SBUX has been down something like 8% so far this year. The Covid pandemic and especially the prolonged restrictions in China have done their part. But this company has managed all that and even came up with an increase in its dividend this year.

Total Starbucks $SBUX revenue rose 11% to nearly $9.4 billion, beating Wall Street's expectations of $9.28 billion, while adjusted earnings per share were $1.06, also beating estimates of $0.97. Global same-store sales jumped 8%. US consumers in particular were willing to pay more for their premium seasonal drink and added record amounts of food to their order. Mostly pumpkin spice and chai tea lattes, these are two very popular drinks.

Speaking to investors,CEO Laxman Narasimhan said that while the team is "navigating through uncertain economies and markets around the world", customer demand and sentiment remain strong. It reflects Starbuck's place in customers' routines and "the long-term durability of this business," he added.

International same-store sales jumped 5%, less than the 6.29% Wall Street had expected. Sales in China rose 5%, beating estimates. Although footfall rose 8%, people ordered less, with the average ticket value falling 3%.

Narasimhan said the team felt good about the "overall return" in China, adding that he was "pleased with how the business is coming together despite all the headwinds that have been there for the last couple of years".

Here's a summary of what the Starbucks field said, compared with Wall Street expectations based on Bloomberg consensus estimates.

Revenue: $9.37 billion versus $9.28 billion expected

Adjusted earnings per share: $1.06 versus $0.97 expected

Same-store sales: 8% versus 6.31% expected.

North America and U.S. same-store sales: 8% versus expected 6.30%.

International same-store sales: 5% vs. expected 6.29%.

Same-store sales in China: 5% vs. 4.64% expected.

Same store sales traffic growth: 3% vs. 3.11% expected.

North America: 2% vs. 1.45% expected.

International: 6% versus 5.67%

Ticket growth: 4% versus expected 3.31%.

North America: 6% versus the expected 5.63%.

International: -1% vs. 5.05% expected.

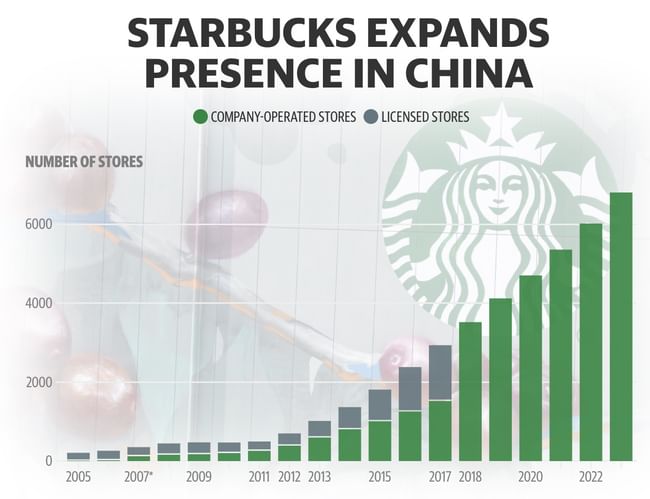

Starbucks $SBUX has invested more in its international business over the years. It recently announced its 20,000 dispensing location outside North America and plans to expand to 9,000 stores in China over the next two years with nearly 1,000 new stores per year.

At the end of last quarter, stores in the U.S. (16,352 locations) and China (6,806 locations) accounted for 61% of the company's global portfolio.

The company added 816 new stores last quarter, bringing the total to 38,038 stores, 52% of which are company-operated and 48% of which are licensed locations. Further, its loyalty program is also growing steadily. In Q4, the number of members with active rewards in the U.S., who typically spend more, grew 14% year-over-year to 32.6 million. In China, there are now 21 million rewards members, up 22% from last year.

So, how many of you like products from this company and who does it also make happy in the portfolio? 😊🍀

The results are nice and the current price is not too bad. So I'll think about buying.

Beautiful post and the results even nicer!