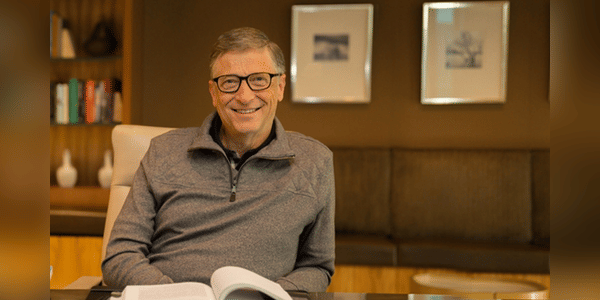

Inspiration for investors: three long-term investment bets of Bill Gates

Bill Gates is one of the most well-known figures in business and investing. The founder of Microsoft regularly appears among the world's richest people, not only because of the success of his technology company, but also because of his long-term and thoughtful investing.

After leaving Microsoft's leadership, Gates focused on diversifying his portfolio, which brought him further success. Let's take a look at three of his long-term investment bets that are worth considering.

Canadian National Railway $CNI

Canadian National Railway (CNI) is one of the most prominent rail operators in North America. It manages more than 22,000 kilometers of track from Canada to the Gulf of Mexico and benefits from the region's long-term economic growth. Gates, through his foundation, owns more than half of the $13.53 billion invested in the company. The railroad giant has earned his trust through long-term capital growth and a steady dividend, which currently stands at 2.1%.

Over the past 20 years, CN Rail's…