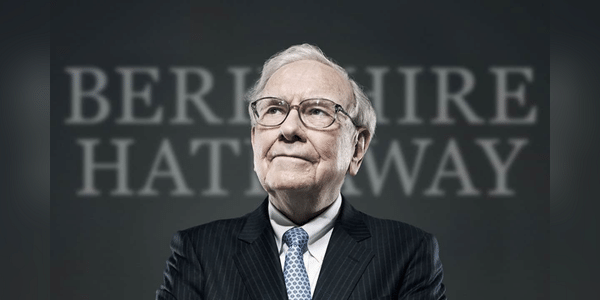

Moving to cash: Buffett's Berkshire cuts stock positions, sells mostly Apple

In the third quarter of 2024, Berkshire Hathaway, led by legendary investor Warren Buffett, significantly sold its stock holdings. The most notable move was the sale of 25% of its Apple stock, which contributed significantly to boosting the company's cash reserve to a record $325.2 billion. The move reflects Buffett's strategy, which currently favors a cautious approach to stock investments.

Berkshire Hathaway reduces stake in Apple

In a report Saturday, Berkshire Hathaway said it sold about 100 million shares of Apple $AAPLduring the summer months , bringing its stake down to 300 million shares. Still, Apple remains Berkshire Hathaway's largest stock investment at $69.9 billion. Despite this decline, Buffett has said in the past that Apple will likely continue to be a key part of Berkshire's investment portfolio, but the stock sale made sense given rising capital gains tax rates.

During the third quarter, Berkshire sold a total of $36.1 billion worth of stock, including several billion…