After years of tough legal battles, write-offs and complex restructuring, it is becoming apparent once again why 3M is an industrial legend. A company that has shaped global manufacturing for more than a century, from medical materials to electronic components, is once again showing its strength in what it does best - discipline, efficiency and the ability to turn vision into profit. The third quarter of 2025 was one of the first when all parts of the restructuring began to show in the results: higher productivity, improved cash flow and growing market confidence.

Under William Brown's leadership, 3M$MMis moving from the defensive to the offensive. The new strategy is based on rigorous cost management, purging the portfolio of inefficient activities and targeting higher value-added areas such as occupational safety, healthcare and high-tech materials. And these steps are now bearing fruit. While a year ago analysts were talking about the need for deep restructuring, today they are talking about stabilisation, growth and a return to long-term profitability.

How was the last quarter?

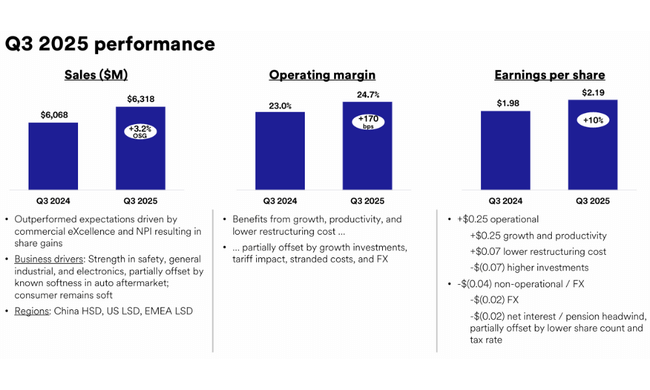

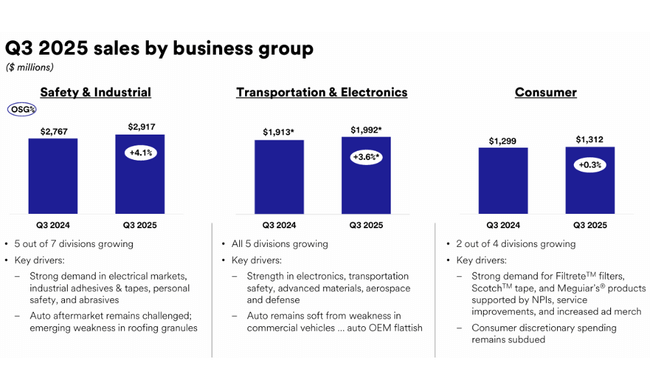

The third quarter of 2025 confirmed that 3M is on its way to regaining its traditional financial strength. Total revenue rose to $6.5 billion, up 3.5% year-over-year. Adjusting for the impact of divisions and the elimination of PFAS products, the company achieved $6.3 billion in sales, or 4.1% growth. Organic growth of 3.2% was driven primarily by the industrial and consumer segments, which benefited from higher demand for professional solutions and technology materials.

There was a fundamental shift in profitability. The operating margin rose to 22.2% and, after adjusting for exceptional items, even to 24.7%, an increase of 170 basis points on last year. Adjusted earnings per share came in at $2.19, a 10% year-over-year improvement. In addition, the company achieved very strong cash flow, generating $1.8 billion from operating activities, leaving $1.3 billion of free cash flow after investments. This result allowed it to continue its program of returning value to shareholders through dividends and buybacks of $0.9 billion.

These numbers were driven primarily by streamlined manufacturing processes, improved supply chains and overall disciplined spending. 3M also benefited from a better product mix and a shift in focus to higher margin segments, which translated into operating profit growth despite relatively conservative sales growth.

Outlook

The strong performance during the first nine months of the year has allowed the company to raise its full-year outlook. 3M now expects adjusted revenue growth of over 2.5%, operating margin expansion of 180-200 basis points, and earnings per share in the range of $7.95 to $8.05. It also aims to achieve more than 100% free cash flow to earnings conversion, a key indicator of financial discipline and stability.

This move confirms management's confidence in its own transformation plan - a strategy that is based on the principle of "less but better". Rather than chasing revenue growth at any cost, 3M is focused on profitability, portfolio quality and long-term shareholder returns. If the company can maintain its pace of profitability growth for the rest of the year, it could become one of the most surprising comebacks among U.S. industrial titles.

Long-term results

The year 2024 was a breakout year for 3M. After a particularly challenging period, when it faced billions of dollars in costs related to litigation and depreciation, the company returned to a profit of $4.17 billion, compared to a loss of nearly $7 billion a year earlier. Revenues fell due to the sale of some assets, but operating performance improved dramatically, with margins and net income returning to levels that reminded investors of the pre-2020 era of stability. EBITDA climbed back above $4.8 billion after several years of decline, and management resumed dividend growth.

The long-term direction is clear: 3M is seeking greater capital efficiency and reduced operating costs, which are already translating into higher returns on capital. As legal cases and portfolio transformation come to a close, the company could once again achieve steady earnings growth in the higher single-digit percentages per year over the next few years.

Recent developments also reveal the critical role played by structural changes in the portfolio. 3M has gradually reduced its exposure to the chemicals segment (particularly PFAS), which had burdened it with billions of dollars in compensation, and focused on areas of higher technological value and stable demand - medical materials, industrial components, filtration systems and safety equipment. Today, these segments form the mainstay of growth and allow the company to achieve a return on capital that is once again approaching historical levels of around 15% after the 2023 slump.

In terms of cash flow, 3M has returned to being among the industry leaders. The company has been able to maintain positive operating cash flow and a disciplined capital policy through turbulent periods. Reductions in capital expenditure, the winding down of inefficient projects and better inventory management have resulted in free cash flow to earnings conversion remaining above 100%. As a result, 3M has been able to afford to maintain the dividend it has paid continuously for more than 65 years and to reinvigorate its buyback program in 2025.

Shareholder structure

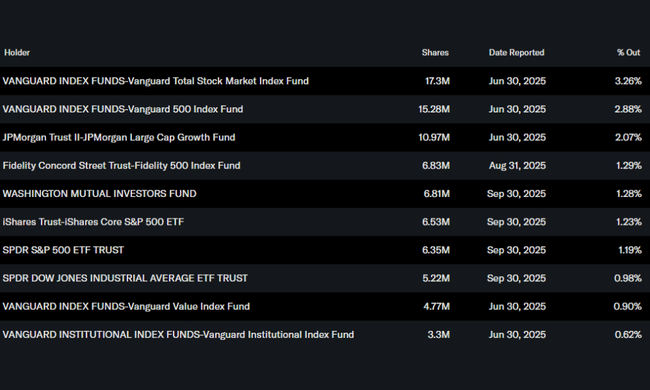

The shareholder structure shows strong institutional trust. Approximately 75% of the shares are held by institutional investors, led by the Group's funds Vanguardwhich together control over 6% of the company. This is followed by JPMorgan Large Cap Growth Fund a Fidelity 500 Index Fund. Insider holdings remain negligible (0.1%), consistent with the nature of a widely held public company.

Analyst expectations

After a string of positive quarters, there is cautious optimism among analysts. The market mainly appreciates the rising operating margins and the consistent cost reduction. Many analysts expect 3M to further strengthen profitability in 2026 due to continued production optimization and demand growth in the healthcare and security segments. The long-term goal is to return to double-digit ROE, which would mark a major turnaround in the industry giant's story after previous years.