As global stock markets navigate increased volatility and investor sentiment wavers, the Federal Reserve is signaling a cautious shift away from an anticipated rate cut at the December meeting. With inflation remaining stubbornly above target and economic data clouded by recent disruptions, the uncertainty around U.S. monetary policy has become a key risk factor for equities. Investors must now weigh whether the Fed’s reluctance to ease is a prudent guardrail against overheating—or a misstep that could stifle growth and trigger a broader sell-off.

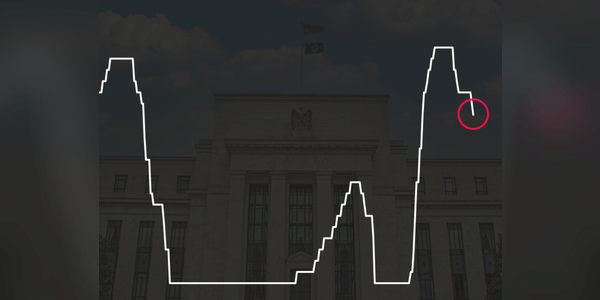

Chart of US interest rates since 2006

Think of the stock market as a big ship on a rough (economic) sea, with the Fed as captain, steering the course with interest rates. Lower rates mean cheaper borrowing, which encourages corporate growth and consumption, while higher rates put the brakes on inflation and overheating of the economy.

The heated debate within the Fed over a possible December interest rate cut brings up a fundamental question for…