Alibaba’s latest quarter signals a clear strategic inflection point rather than a traditional earnings story. Revenue growth remains modest, but the internal composition of the business is shifting rapidly. Management is actively pruning lower-return activities, simplifying the corporate structure, and reallocating capital toward areas with the strongest long-term optionality. Cloud computing, artificial intelligence, and high-frequency local services are now firmly at the center of Alibaba’s capital allocation and execution priorities.

This repositioning comes with an explicit short-term cost. Operating profit and cash generation declined, not because demand weakened, but because investment intensity increased sharply. For investors, Q3 is best interpreted as a transition phase: Alibaba is trading near-term margin stability for strategic depth, technological relevance, and future scalability. The key question is no longer whether profits dipped this quarter, but whether these investments can re-establish Alibaba as a core infrastructure player in China’s next digital cycle.

What was the last quarter like?

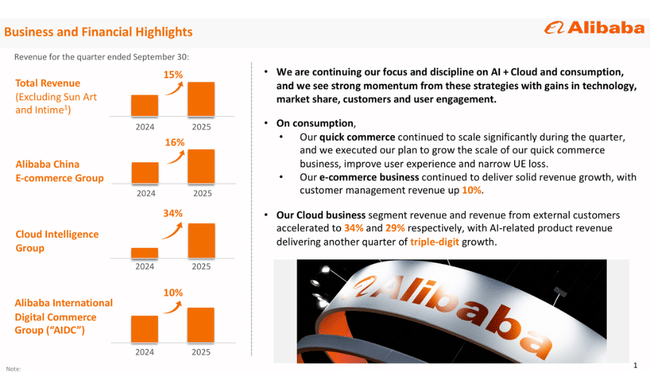

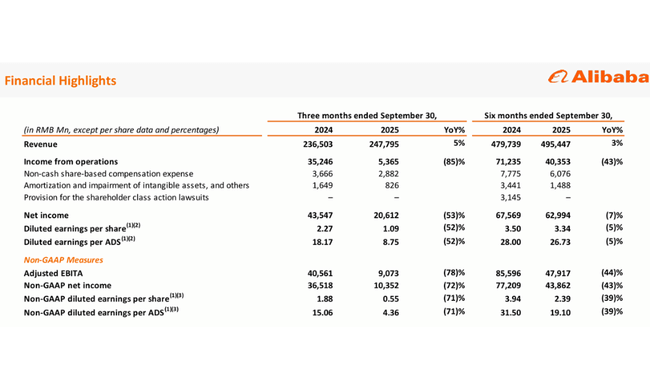

In the third quarter of 2025, Alibaba's consolidated sales of $BABAreached CNY 247.8 billion, representing a year-on-year growth of approximately 5%. However, this figure is heavily skewed by changes in the company's portfolio. Adjusted for divested businesses, mainly Sun Art and Intime, organic revenue growth would be around 15%, which better reflects the actual dynamics of key segments. The core business is therefore growing at a solid pace, but it is not "strength-based" growth - it is a combination of higher monetisation, improved user experience and the expansion of higher value-added services.

The operating result, on the other hand, was significantly weaker. Operating profit was only CNY5.4 billion, down more than 80% year-on-year. Adjusted EBITA fell to CNY9.1 billion, also with a dramatic year-on-year decline. However, this development is not the result of a collapse in demand or price pressure, but a direct result of consciously increased investment. In the quarter, Alibaba significantly increased spending on AI model development, cloud infrastructure expansion, logistics network and fast delivery support within China's e-commerce ecosystem.

Net profit attributable to shareholders was CNY21.0 billion, down approximately 53% year-on-year. On a non-GAAP basis, the decline was even more pronounced, confirming that the current quarter is primarily weighed down by operating expenses rather than one-off accounting items. From an investment perspective, the key point is that this is not a deterioration in margins in the core segments, but a transitional phase of increased capital intensity.

Cash flow development was also significantly weaker. Operating cash flow fell to CNY10.1 billion and free cash flow went into negative territory, at around CNY21.8 billion. However, again, high capital expenditure was the main factor. Over the past four quarters, Alibaba has invested roughly CNY120 billion in AI and cloud infrastructure, a level unprecedented in the company's history. However, a strong cash position in excess of CNY 570 billion gives the firm comfort to fund this investment cycle without pressure on its balance sheet.

CEO commentary

CEO Eddie Wu identified the current period as a key phase of long-term transformation. He emphasized that the goal is not to maximize short-term profits, but to build a technology and infrastructure platform that will enable Alibaba to remain relevant in the era of AI-driven economy. According to the management, decisions are being made now on who will dominate cloud, enterprise AI solutions and digital consumption in Asia in the next decade.

CFO Toby Xu followed up by saying that the company is willing to accept short-term volatility in profitability in exchange for long-term ROI. He also stressed that financial discipline remains a priority and that any major investment is assessed for future returns and scalability.

Outlook

Management did not provide specific numerical guidance at the profit level, but clearly indicated the direction of future developments. Investment in AI and cloud is expected to remain high in the coming quarters, with the growth rate of the cloud segment expected to accelerate further. In e-commerce, unit economics are expected to gradually improve, particularly in the fast delivery area, where economies of scale are already starting to show.

Thus, in the short term, a return to historical operating margins cannot be expected, but in the long term, management believes that the combination of cloud, AI services and more advanced monetization of the user base will lead to higher and more stable profitability than in the past.

Long-term results

A look at Alibaba $BABA's long-term numbers shows a company that has been able to maintain steady growth despite regulatory and macroeconomic turmoil. Revenues have grown from CNY853 billion in 2022 to nearly CNY996 billion in 2025, representing a cumulative growth of over 16%. This growth is all the more significant given that it took place in an environment of a slowing Chinese economy and increased competition.

Gross profit grew from CNY314 billion to CNY398 billion over the same period, an increase of more than 25%. Gross margin improved gradually, reflecting a shift towards higher value-added services, particularly in cloud and digital services. Operating profit rose from CNY69.6 billion in 2022 to CNY140.9 billion in 2025, more than doubling in three years.

Net profit development is even more significant. This increased from CNY62.2 billion in 2022 to CNY130.1 billion in 2025, an increase of more than 100%. Moreover, EPS growth has been supported by a systematic reduction in the number of shares outstanding through share buybacks, which have reduced the average number of shares by more than 10% during the period under review.

EBITDA rose from CNY128 billion in 2022 to CNY183 billion in 2025, confirming that the company's underlying cash-generating capability remains strong even in a period of increased investment. The long-term numbers thus clearly show that the current cash flow pressure is cyclical, not structural.

News

Key developments include the continued expansion of AI products in the cloud segment, where Alibaba recorded its ninth consecutive quarter of triple-digit growth in AI services revenue. The company is also further expanding its data center infrastructure and strengthening its collaboration with large enterprises and the public sector.

In e-commerce, Alibaba is focusing on fast delivery, improved user interface, and deeper integration of payment and logistics services to increase customer loyalty and the long-term value of its user base.

Shareholding structure

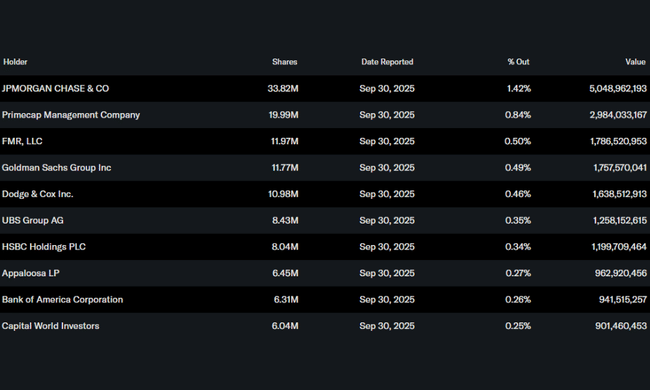

Institutional investors hold approximately 12% of Alibaba's shares, a relatively low proportion compared to US tech giants. The largest institutional holders include JPMorgan, Primecap, Fidelity and Goldman Sachs. Low institutional exposure means higher volatility, but also potential room for a change in sentiment if global investor confidence in China's technology sector improves.

Analysts' expectations

Analyst views remain divided. The more optimistic part of the market sees the current investments as a necessary step for Alibaba to remain a technology leader in the AI era. More conservative analysts point to near-term cash flow pressures and the risk that investment returns may come later than the market expects.