Famed investor Jeremy Grantham said the "super bubble" he previously warned about has not yet burst, even after this year's turmoil in the US stock market. Grantham became famous for observing and profiting from bubbles in Japan in the late 1980s, technology stocks at the turn of the century and in US housing before the 2008 financial crisis. I'm not saying his predictions worked 100% of the time, but more than once they did and he was able to profit handsomely in the process. So let's take a look at how he sees it and what his concept of a super bubble represents.

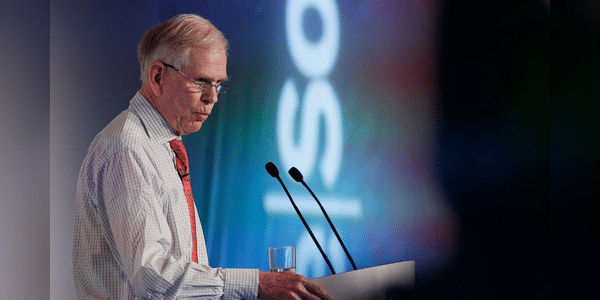

Legendary investor Jeremy Grantham.

Who is Jeremy Grantham anyway?

Grantham is the co-founder and chief investment strategist of Boston-based asset manager GMO (one of the most respected asset management firms in the world), which is known for defining and finding market bubbles. He currently manages approximately $70 billion in assets and is often considered a market skeptic. He is often dubbed a perma-bear, but that doesn't…