When searching for suitable stocks for your dividend portfolio, you come across quality, historically proven companies that regularly increase their dividend. However, their dividend yield rarely exceeds, say, 6%. But it's a different story with younger, little-known companies whose dividend yields can get well over 10%. That is what this text is about.

1. CVR Partners $UAN

This is a limited partnership company that manufactures and sells nitrogen fertilizers in the US. Its products include ammonia products for both agricultural and industrial customers, as well as urea and ammonium nitrate products. The company was founded in 2007 and is headquartered in Texas.

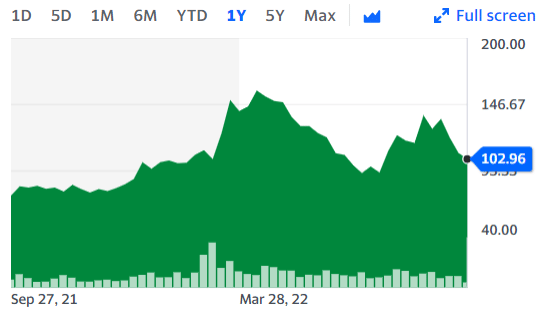

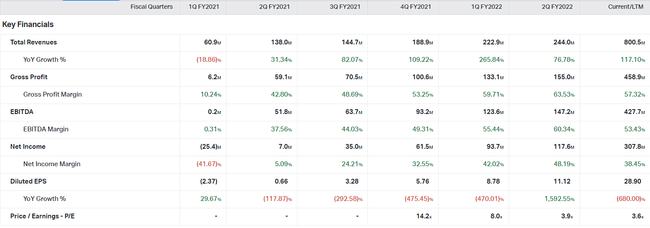

The stock last traded at $102.96, up 50% from a year ago. Despite the halved price, it shows a PE ratio of only 3.56. That's decent considering the company was still loss-making in 2020. Now the dividend yield is over 20%. This is due to the giant quarter-over-quarter increase in dividend per share. The dividend paid in May was $2.26 per share, whereas the August dividend was already $10.05 per share. The payout ratio is around 42%. In addition to a decent dividend, the company is also undertaking buybacks. This is a positive signal after issuing new shares in 2016.

Taking a quick look at the recent quarters in terms of numbers, we can say that the company is improving its results. As we can see in the screen below, it has been regularly increasing sales by tens of percent, which were $244 million last quarter. Along with sales, gross profit is also rising, but more importantly, gross margin is rising. The company has finally managed to turn a profit in the past year. The net margin is also growing rapidly, having reached 48% last time. Quarter-on-quarter, the PE ratio is falling significantly.

How do analysts at Seeking Alpha view CVR Partners? 5 out of 4 are recommending a buy. With one setting the company's rating at Strong Buy, 3 at Buy. One analyst, on the other hand, recommends Sell.

2. SITC International Holdings Company Limited $SITIY

SITC International Holdings Company Limited is a transportation logistics company that provides integrated transportation and logistics solutions primarily in Asia but also globally. Its two main segments are container shipping and logistics, dry cargo and others.

The container shipping and logisticssegment offers container transportation, freight forwarding, freight brokerage, and warehousing services. The Dry Cargo segment provides dry cargo chartering and land transportation services, as well as air freight forwarding services. The company was founded in 1991 and is headquartered in Hong Kong.

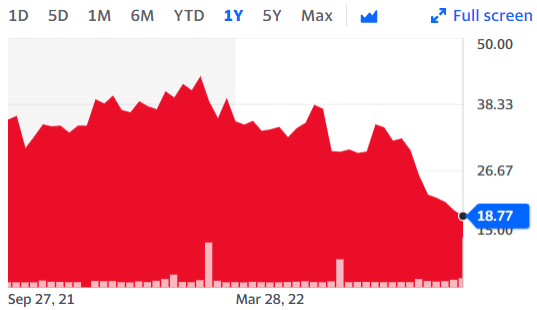

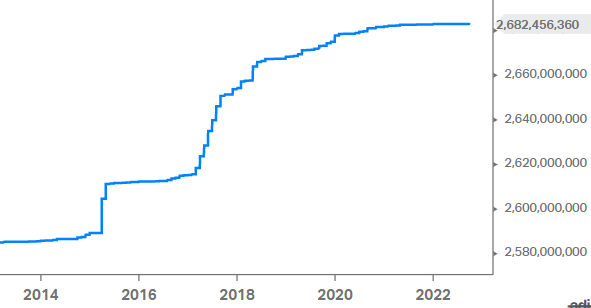

The company's stock ended the last trading session at $18.77, representing a one-year drop of nearly 58%. The drop caused the PE ratio to drop to a very low 2.8. However, the issuance of new shares in the previous years can be blamed for such a low price. The company has only been paying dividends since 2019, and from the first payout in 2019 of $0.3322 per share, the dividend has already climbed to $3.0575 in August this year. So, given the current price, the dividend yield comes out to 30.46%. The payout ratio is 59.55%. While that's a great number in and of itself, it would be better in the future if the company could reduce the number of shares instead of diluting shareholders.

3. Grupo Aeroportuario del Centro Norte $OMAB

Grupo Aeroportuario del Centro Norte owns the rights to develop, operate and maintain airports in Mexico. The company operates 13 international airports. In addition, it provides aviation services that include passenger services, aircraft landing and parking, passenger boarding and deplaning, passenger walkway, and airport security services.

It also offers ancillary services that include space rental to airlines, cargo handling, baggage screening, permanent and non-permanent ground transportation and access rights services. Among other things, the company provides construction services. Thus, we can see that OMAB is quite well diversified within Mexico.

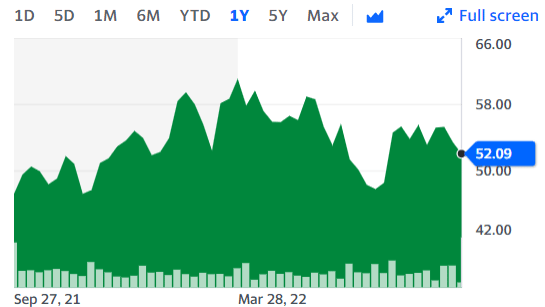

OMAB last traded at $52.09, a slight increase of 7.89% from last year. The asset price sets the PE ratio at 14.52. The company has been paying dividends since 2007. The last dividend was $0.5005 per share. Therefore, given the current price, the dividend yield comes out to 14.64%.

Within the dividends, we may be struck by the payout ratio, which is 231.78% over the past 12 months. This could be a problem as the ratio should not normally exceed 100%. However, this could be a similar oversight to tobacco producer Altria, whose extremely high payout ratio is due to tax write-offs. I see regular share buybacks as a plus. The company has managed to reduce its share count by 3% since 2014.

What do analysts think of this Mexican company? Within Wall Strett, experts think now is a good time to buy the stock. In the last 3 months, 7 out of 8 analysts have rated OMAB with a Buy rating, while one analyst would only hold the stock and not buy it. CNN Business also has a similar view, 12 of their 16 analysts would buy now. The price target for the next year is set at $65.45, a 24.86% upside.

Have you known any of the companies before? Do you think dividends this high are sustainable over the long term? 🤔

This is not an investment recommendation.