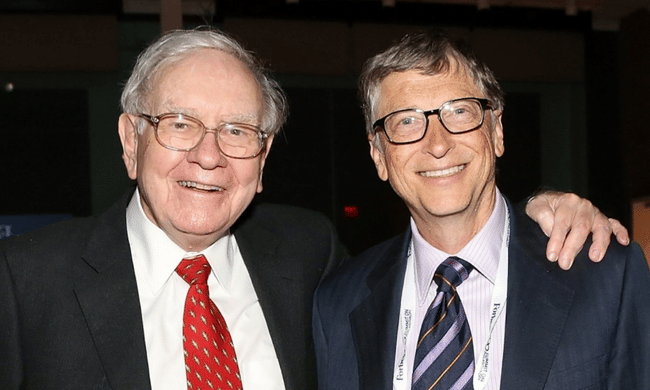

In addition to investing in companies, Warren Buffett, the most successful investor of all time, also focuses on farmland. His long-time friend Bill Gates is in a similar vein. Why farmland can be interesting to the average investor and how to invest in it are discussed in this article.

One thing that both Warren Buffett and Bill Gates have in common is that they both love farmland as an investment. Buffett bought his first farm before high school in his home state of Nebraska for about $10,000. Gates owns more than 242,000 tillable acres. It is also reported that Buffett owns a 1,500-acre family farm in Pana, Illinois, and three research farms operated by the foundation, including more than 1,500 acres in Arizona and 9,200 acres in South Africa.

Why farmland?

Over the past 30 years, the average inflation-adjusted return on farmland has been around 5%. That's a pretty solid investment for long-term investors. However, in addition to super-rich people like Buffett and Gates, others have found this out. The U.S. Department of Agriculture (USDA) reports that 30% of farmland in the U.S. is owned by owners who do not farm it themselves. Such long-term investors - like Buffett, Gates and others - understand that there is no real downside to investing in farmland, but potentially significant upside. This sentiment is probably truer today than ever before,

Past risks in farmland investment

There was a time, however, when investing in farmland was quite risky. The USDA reports. In the mid-1980s, farm prices fell due to surpluses, inflation slowed, and demand for farmland declined. These factors caused the second large decline in farmland values in a century. Land values fell from $801 in 1984 to $599 in 1987, a 25 percent decline. This sharp decline has caused great hardship in the farming community. Many farmers, who had taken on large amounts of debt based on exorbitant land values, were unable to continue operations. Farmland values have steadily increased since 1987 to the current U.S. average of $1,050 per acre.

Because of what happened in the 1980s, the U.S. government has since taken as much risk out of agriculture as possible through its crop insurance program. Government spending on the program in 1981 was approximately $200 million, while in 2021 over $8 billion was spent. Annual government subsidies also protect farmers from falling prices and poor yields. Such subsidies cost taxpayers over $5 billion annually. Recently, more than $29 billion in COVID-19 assistance funds were paid to agricultural concerns through the law, and the December 2020 stimulus bill provided another $13 billion to agriculture.

Invest with ETFs

Average investors don't have the deep pockets of billionaires to buy acres of farmland. An investor might buy a small farm somewhere, but there would still be the hassle of who would farm the property, who would plant in the spring and who would harvest in the fall, not to mention dozens of other things that would need to be done.

But the average investor can participate in farmland investing by buying agricultural mutual funds, exchange-traded funds - ETFs.

TheVanEck Agribusiness ETF (MOO) offers investors exposure to a mix of stocks operating in the agriculture sector. Its holdings are primarily in developed regions, but it also owns global farmland in emerging markets, including Brazil, Malaysia and Singapore. The ETF charges a 0.52% management fee. Another popular ETF is the iShares MSCI Global Agriculture Producers ETF (VEGI). This fund includes equity securities of companies in the agricultural sector in both developed and emerging regions. The management fee here is slightly lower at 0.39%.

Summary

Although the returns may seem relatively low, investing in an agricultural ETF carries several benefits. It can help diversify your portfolio and minimize risk. And because there will always be demand for agricultural products, farmland ETFs provide an investment hedge.

DISCLAIMER: All information provided here is for informational purposes only and is in no way an investment recommendation. Always do your own analysis.