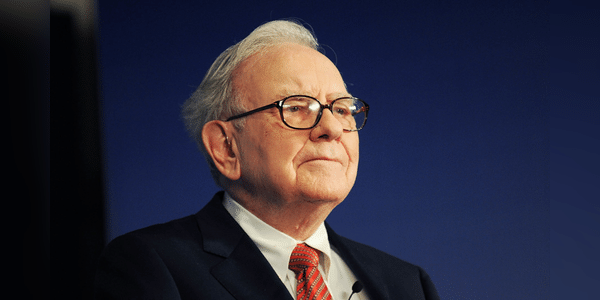

It's no secret that Berkshire Hathaway CEO Warren Buffett likes financial sector stocks. Of his current 49 holdings, financial sector stocks take up nearly a quarter of his portfolio. However, this share is smaller than it used to be, and mainly for two reasons. The first is Buffett's purchases of oil and gas companies over the past six months, and the second is the more than 60% reduction in his position in U.S. Bancorp stock, which for many years was one of Berkshire's largest positions. And it is this dramatic sale that we take a closer look at in this article.

The well-known investor's conglomerate has sold 84 million shares of parent company US Bank $USB since June 30, according to a Securities and Exchange Commission filing on Thursday.

Buffett's company counts U.S. Bancorp among its largest holdings since 2007 and owned 145 million shares worth $8.1 billion at the beginning of January. It now holds only 53 million shares worth $2.4 billion, reflecting its share…

nice info. thank you. i am so glad to read this

nice info. thank you. i am so glad to read this

As time passes and the antitrust investigation unfolds, Activision Blizzard stock is down to $72, making this an attractive bet. Buffett's holding company, Berkshire Hathaway, has also taken a targeted interest in ATVI stock this year. Let's take a look at why Buffett was interested.

have shown

Enjoyed and read twice.

good

wow

nice

good

wow