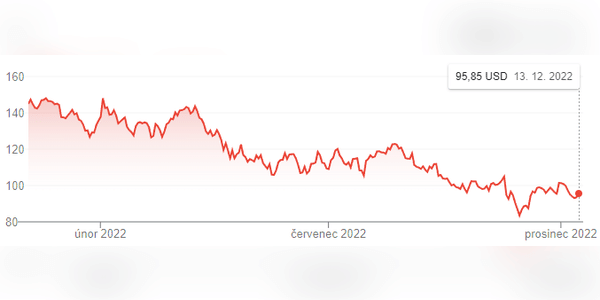

"Big tech" stocks have lagged the broad S&P 500 index this year, and online advertising giant Alphabet is no exception. Its stock is down nearly 34% year-to-date compared to the S&P 500, which has erased about 16%. Here are 3 reasons why this underperformance in GOOG stock could persist into 2023.

On closer inspection, however, the question is whether improving economic conditions will mean a big rebound for the tech giant's stock. The road back to its all-time high closing price ($150.71 per share ) could be much longer than currently expected.

There are three factors, all of which will remain in play even after today's problems, such as inflation and slowing economic growth, are resolved. With that in mind, the stock (just under $100 per share today) may not be the opportunity to miss that some think it is.

These 3 factors could limit the future returns of Alphabet stock

Even after a prolonged pullback…

NICE POST THANKS!

NICE POST THANKS!

Start posting, ask questions, discuss. Quality posts will be displayed on the main page!

https://dovevedereprofetistreamingitalino.statuspage.io/https://cb01profetifilmaltadefinizionehdsubita2023.statuspage.io/

https://www.scoop.it/topic/cb01-film-profeti-streaming-ita-in-altadefinizione-2023-by-gewomohttps://www.scoop.it/topic/me-contro-te-il-film-missione-giungla-2023-film-completo-streaming-ita-in-linea-gratis-2023-by-pebavaf-nknjhttps://www.scoop.it/topic/il-gatto-con-gli-stivali-2-l-ultimo-desiderio-streaming-sub-ita

https://www.showwcase.com/show/32919/cinema-il-gatto-con-gli-stivali-2-lultimo-desiderio-2023

However, a third factor (increasing competition) may spoil the chances of that happening. High competition for market share between Alphabet and rivals like Amazon and Microsoft may limit future growth and swing to profitability of its cloud business.

third factor (increasing competition) may spoil the chances of that happening. High competition for market share between Alphabet and rivals like Amazon and Microsoft may limit future growth and swing to profitability of its cloud business.

wow amazing post

haseum

Give the stock a slight boost

good