That a recession is coming is almost certain according to most of the investing world. It is now more a question of predicting the course more accurately. And with one frighteningly accurate one comes a well-known billionaire CEO.

The United States is on the brink of a recession that could put millions of Americans out of work. Barry Sternlicht, chairman of the Starwood Capital Group investment fund and billionaire, appeared on CNBC to relay his timeline of the coming recession. Here's how he thinks it will play out.

What's going to happen?

"The recession will happen in the third or fourth quarter. Consumers are out of money. Their savings rate is at an all-time low."

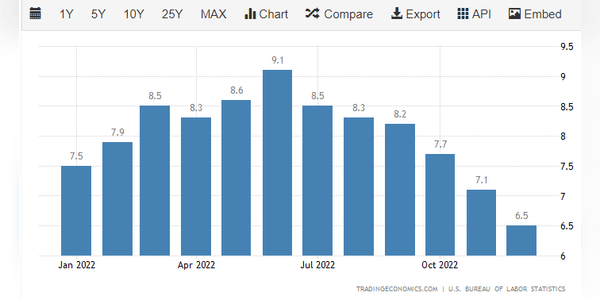

On the other hand, he comes with better news, because Sternlicht expects inflation to be negative before the recession hits in the second half of the year.¨

"Inf…