2022 was an extremely bad year for stocks. And this year's, despite January's growth, does not bode well. But dividend stocks are always a good choice for bad times. Could this stock be a good choice for your portfolio?

The Dow Jones Industrial Average $^DJI, the S&P 500 $SPY and the Nasdaq Composite $^NDX have entered a bear market🐻 and posted their worst performance since 2008, down 9%, 19% and 33%, respectively.

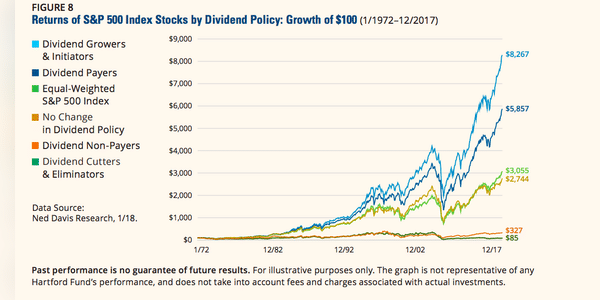

However, if there's one investment strategy that tends to do quite well during a bear market, it's buying dividend stocks. Companies that pay a dividend have demonstrated the ability to successfully weather economic downturns and tend to be repeatedly profitable. Best of all, income stocks have a long history of outperforming companies that don't offer a dividend.

Dividend stocks with superior yields may be tempting, but the risk tends to grow with the yield. However, this is not true for all dividend…