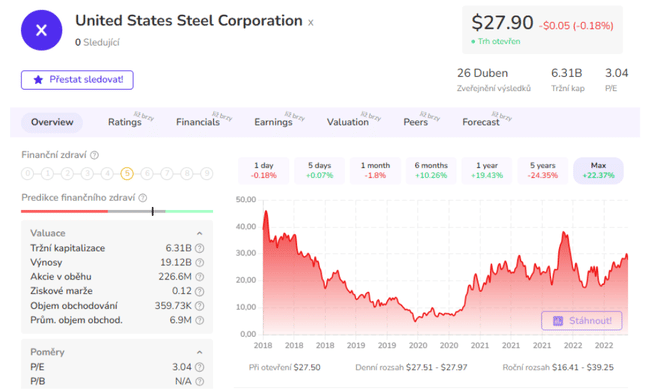

Today, I'm wading into somewhat uncharted waters to analyze U.S. Steel, a company that has a dominant market position but is not as widely known and well-known to investors. But can it be an attractive option for investors?

U.S. Steel is an American steel company that manufactures and sells steel and other metal products. The company was founded in 1901 and is one of the largest steel companies in the world. Its products are used in a number of industries such as automotive, construction, transportation and energy.

U.S. Steel is committed to sustainability, competitiveness and has made great efforts to improve its manufacturing processes and reduce its environmental impact.

The company is particularly interesting because of its history and position in the industry. It was one of the first major steel companies in the history of the United States and is still one of the largest in the world. It has extensive manufacturing facilities and supplies its products worldwide. The company also strives to be a leading pioneer in sustainability, which is important to many people.

In addition, U.S. Steel has a long and rich history that is linked to the development of the industry in North America. The company has been involved in many important projects, such as the construction of the Panama Canal, and has also been involved in many important events in American history, such as both World Wars.

In recent years, U.S. Steel has won a number of interesting contracts. For example, in 2020, the company signed a contract with the U.S. government to supply steel for the construction of a new bridge in Detroit Bay. The company has also expanded its operations in Asia, becoming one of the largest suppliers of steel to the automotive industry in the region.

In recent years, U.S. Steel has also sought to expand its product offerings in the area of sustainability, for example by producing steel tubes for solar and wind power plants. These activities are part of an effort to reduce its environmental impact and position itself in the market for sustainable products.

United States Steel Corporation has several competitive advantages, including:

Extensive manufacturing facilities: the company has some of the largest and most modern manufacturing facilities in the industry, which allows it to produce large quantities of high quality steel. As a point of interest, they also have a plant in Slovakia outside of the US.

United States Steel Corporation has over a century ofhistory and is one of the oldest and most stable companies in the industry.

Excellent research and development: the company invests heavily in research and development, which enables it to bring new products and innovative solutions to the market.

Strong supplier relationships: the company has strong ties with raw material suppliers and partners, enabling it to secure quality raw materials at competitive prices.

Extensive store network: the company has an extensive network of stores worldwide, enabling it to respond quickly to customer demand and provide quality service.

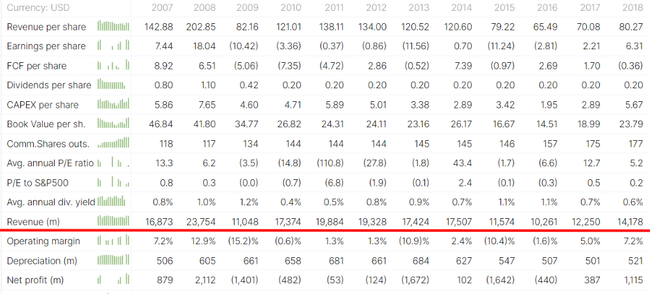

Before we look at the company's specific numbers, we have to remember that this is a cyclical stock, which always carries some risks 🚨.

Cyclical stocks are stocks of companies whose performance is closely linked to the performance of the economy and the economic cycle or the price movements of certain commodities. In times of economic growth, demand for the products of these companies increases and thus their profits increase, while in times of economic downturn, demand decreases and profits fall. Therefore, cyclical stocks are often considered volatile and riskier investments.

I only mention this because the last few years (specifically post covide) have seen a relative explosion in demand for their products, which has massively affected the numbers, whereas with a possible recession coming, we can again look at the numbers from the years before covide, due to reduced demand and the volatile price of steel and others.

To show the cyclicality, we also need to know the bigger picture in terms of commodity prices, specifically steel is one of the most needed commodities for this particular company. As you can see, the literal explosion in 2021 was quite shocking, whereas we are currently at such an average when looking at the chart with a wider span of years.

Knowing that this is a cyclical stock and there are some pretty promising years behind us, I think it's clear that the numbers in the last 3 years or so are going to be huge 👇.

Overview of sales in the last 3 years 👇

- 2022 = $21.065B, a 3.9% increase over 2021

- 2021 = $20.275B, a 108.14% increase from 2020

- 2020 = $9.741B, a 24.7% increase from 2019

Comparing this to the pre-Covid period, that's a pretty decent jump in terms of revenue. But you can see a nice demonstration of the aforementioned cyclicality and fluctuation over the years.

An overview of net profit over the last 3 years 👇

- 2022 = $2.524B, (+39.53% YoY)

- 2021 = $4.174B, (+458.28% YoY)

- 2020 = $-1.165B, (+84.92% YoY)

A look at long-term debt over the last 3 years 👇

- 2022 = $3.914B (1.32% increase from 2021).

- 2021 = $3.863B, 17.72% (increase from 2020).

- 2020 = $4.695B, 29.45% (increase from year) 2019.

Summary of free cash flow over the last 3 years 👇

- 2022 = $1.768B (+45.65% YoY)

- 2021 = $3.253B, (+874.52% YoY)

- 2020 = $-0.42B, (+25.8% YoY)

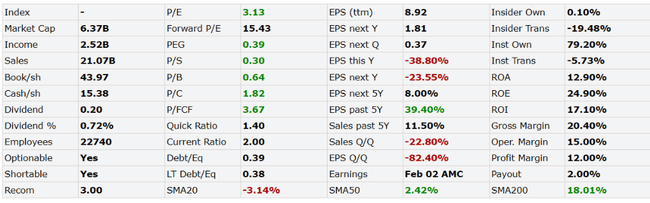

When we look at ratios such as P/E, P/B and P/S, we see lower than sector average numbers for all of them.

To compare to the sector average - The average P/E is 12.5, the average P/S is 1.11 and the average P/B is 1.86.

What to expect next?

We already know this is a cyclical stock, so promising results may not be followed up. All indications are that the U.S. steel industry will continue to improve in 2023, but steelmakers can't help but warn investors that a recession is possible in the second half of the year, which could change those expectations.

U.S. Steel Corp, one of the largest domestic producers, said it is optimistic about demand, noting that sentiment turned positive at the start of the year.

"There's a lot of things around the corner, no question about it, that are unknown," Burritt said on a conference call with analysts. "Maybe a mild recession in the second half of 2023 and a strong recovery in 2024."

Such comments come after Nucor Corp, the largest U.S. steelmaker, told shareholders that a recession could affect future demand. Since then, Nucor and Steel Dynamics Inc have shaken off the sluggish end to last year by hinting that better times are ahead.

How does the company itself see things at this point?

U.S. Steel forecast flat-rolled steel shipments of about 8.5 million to 9 million tonnes, which was higher than the average analyst estimate of 8.2 million tonnes. The Pittsburgh-based company said the first quarter will mark a "bottom" for the market this year, with obstacles to economic growth, including weakening manufacturing activity, declining housing permits and a host of geopolitical risks.

Risks

Cyclicality and environmental impacts 👇

1. the price of steel may actually decline during a recession. This is often the result of a decline in demand for building materials, automotive and other industries that use steel. If companies in these industries are forced to reduce their production volumes, this can have an impact on the demand for steel and thus on its price.

2. The environmental impact may not be such a threat when a company delivers on everything it has promised, but it is a bogeyman in the closet that we have to take notice of, none of us know what standards or restrictions may arise.

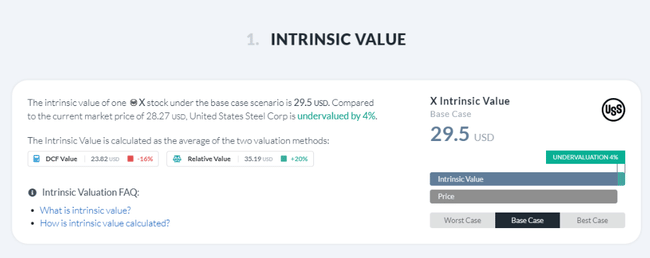

I've made my job a little easier with the price calculation today, so I'll use the alphaspread website, where according to their calculation the stock is slightly undervalued 👇

I'd be careful with the calculation and price estimate though, as I've written several times, this is a cyclical stock, so despite the expectation of a promising outlook, this thesis could be undermined by a recession, which would surely affect the share price.

Please note that this is not financial advice. Every investment must undergo a thorough analysis.