Analysis of Boxlight Corp, a company that brings revolutionary solutions to education

Small-cap companies are generally associated with unprofitability, greater risk, but above all with greater growth potential. So today, we're going to look at one such company that is starting to gradually pick up and improve its performance.

Boxlight Corp $BOXL is an American education technology company. The company's main focus is to develop, manufacture and distribute interactive technologies that help educators and students improve teaching and learning.

The company's main products include interactive whiteboards, projection devices, digital learning materials, virtual reality, and other technologies that make education more effective and interactive.

Boxlight Corp strives to offer comprehensive solutions to modernize learning and also provides consulting services to implement technology into the educational process.

These are their main products

Clevertouch Technology - Smart (Touch) Boards

Mimio - Mimio offers various solutions for using interactive technology in the classroom, including interactive whiteboards, projectors, wireless tablets, software for creating and sharing learning materials, and more.

Boxlight EOS - EOS Education reaches educators and business professionals, providing certifications and training solutions that ensure successful technology integration, increased efficiency and effectiveness with better results. 🚨 Boxlight is also a Google Cloud Partner and Microsoft in Education Global Training Partner, among others.🚨

FrontRow - FrontRow is a brand of audio and video systems that are primarily used for sound reinforcement in classrooms, conference rooms and other environments. These systems consist of microphones and speakers that are designed to provide high quality sound and ease of use.

Boxlight Corp is an interesting company for several reasons:

Focus on the education market: the education industry is a large and growing market, and Boxlight Corp is focused on technology that helps educators and students improve teaching and learning. This market has increasing potential as education becomes increasingly digital and technological.

Innovative Products: Boxlight Corp manufactures innovative products for education such as interactive whiteboards, projection devices, digital learning materials and virtual reality. These products allow educators and students to learn more interactively and effectively and can help improve student outcomes.

Growth and Expansion: Boxlight Corp is growing and expanding rapidly. The company has made several acquisitions in recent years and has expanded its product portfolio. It is also looking to expand into new markets and countries, which could lead to further growth.

Boxlight Corp operates in markets around the world. The main markets where the company operates are North America and Europe, but it also has customers in Asia, Australia, Africa and South America. Overall, Boxlight Corp has a global footprint and is looking to develop its business in new markets around the world.

Financial view

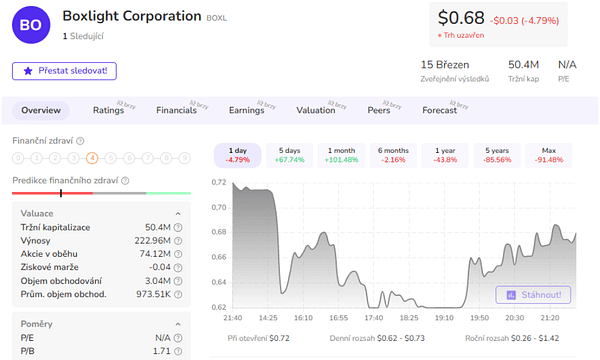

We don't know the results for Q4 2022 yet, so here we can take a look at the outlook through the eyes of analysts 👉 For the full year 2022, analysts expect revenue growth of $250 million and adjusted EBITDA of $26 million.

- If this prediction comes true, it will mean that the company continues to gradually improve its numbers from year to year.

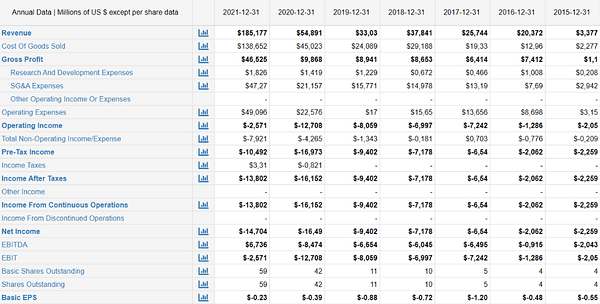

The revenue growth here is quite dramatic, with 2015 revenue at just $3.37m, while we're talking $185m in 2021, and with 2022 expectations of $250m.

But as I mention at the beginning, small-cap companies are often unprofitable. So when we look at operating income, we still see negative numbers, which was probably impacted by covid and online homeschooling, which hurt the company's results in the short term, but now things are starting to stabilize again.

- Currently, Boxlight Corporation is investing in expanding its business and developing new products and technologies to increase its sales and improve its profitability.

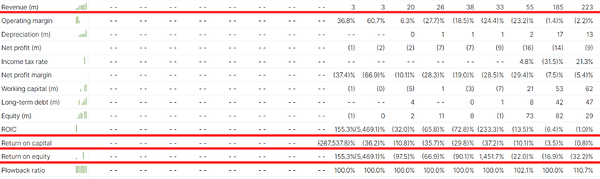

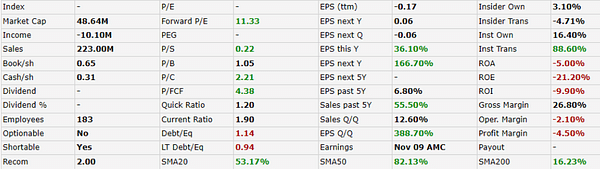

- Debt-to-equity for the three months ended September 30, 2022 carried a value of 0.94.

Boxlight Corporation currently has sufficient funds to meet its short-term obligations and debt repayments. At the same time, the company has sufficient cash and also has a revolving credit facility, which could support the company's future growth.

What is a revolving credit facility? 🚨

Revolving credit is usually provided by banks or other financial institutions and is often used by entrepreneurs or companies to finance operating expenses, purchase inventory or invest in new projects. Borrowers pay interest rates on the amounts they borrow and are usually required to make minimum payments each month.

Revolving credit is usually more flexible than traditional loans because lenders can borrow and repay money according to their needs.

Because of the unprofitability, it is clear that ROA, ROE and ROI are still negative (but there is a gradual improvement over the years).

A look at the results for Q3 2022

- Revenue up 12.7% to $68.7 million

- Net income per diluted common share improved $0.02 to $0.03

- Adjusted EBITDA increased $2.7 million to $9.9 million

- Ended the quarter with $22.0 million in cash, $62.3 million in working capital and $46.8 million in stockholders' equity

Additionally, the company disclosed 👇

- Expect Q4 2022 revenue of $48 million and adjusted EBITDA of $2 million

- Expect full year 2022 revenue of $227 million and adjusted EBITDA of $18 million

We will report Q4 2022 results on March 16, 2023.

In closing, I'm not invested in this company, I only decided to take a look at it because I spotted a rather popular Twitter page discussing ''top ideas for small-cap'' stocks, and it was the $BOXL tip that came up. After a closer look, I liked the company for its focus, but it's still a story to watch, I don't see it as an investment yet, it would be a fairly risky growth speculation, and we've already seen some bounce (over 100% growth) in the last month.

Please note that this is not financial advice. Every investment must go through a thorough analysis.