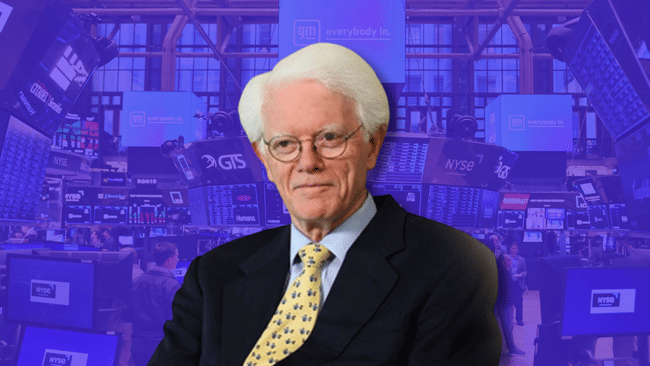

Thanks to the media and the internet, we have one huge advantage. We can draw knowledge and experience from successful people we would not normally have a chance to get close to. In a recent interview with CNBC, Peter Lynch revealed 2 things that he believes are important for investors when analyzing and selecting stocks. So let's take a look at that.

Peter Lynch is one of the most famous investors in history, who rose to fame with his success managing Fidelity's Magellan fund. During his tenure there, he was able to grow the fund's assets from $20 million in 1977 to $14 billion in 1990. His investing philosophy is described in his 1989 book "One Up On Wall Street," where he popularized the idea of investing in what you know. In this article, we'll focus on two key pieces of advice Lynch gave investors in a recent CNBC interview, and warn of one common pitfall.

https://www.youtube.com/watch?v=U-6fv09KCDw

A healthy balance sheet for the company

First, investors should always look at the balance sheet of the company they are considering investing in. A healthy balance sheet can allow a company to grow compared to a company that is in poor financial health and in debt.

The first aspect that investors should look for when buying stocks is a healthy balance sheet of the company. Lynch recommends looking at the debt-to-equity ratio, which is an indicator of a company's financial stability and ability to repay its obligations. Companies with a low debt-to-equity ratio generally have a stronger financial base and are better prepared to face potential economic adversity.

In addition, it is important to carefully examine a company's financial reporting and underlying business trends. Investors should monitor market share, sales growth, margins and other key indicators that may indicate long-term growth and prosperity.

The story of a good turnaround

I think I'm looking for something different. You're looking for something that's a good story... So you need to find a company that is either a turnaround company or a company that is going to grow. You have to look for new companies and look at the balance sheet.

The second factor Lynch recommends looking for when picking stocks is a good turnaround story. This is a situation where a company that was previously going through a difficult period is showing signs of improvement in its business. This may include improved market share, increased efficiency, debt restructuring or other factors that indicate the company is getting back on a growth path.

Investors should be cautious in evaluating these stories and not get carried away by emotions or promises alone. It is important to conduct a thorough analysis of the company and ensure that positive trends are supported by real numbers and indicators.

At the same time, Peter Lynch cautions investors against chasing speculative stock rises and recommends not buying stocks just because they are rising.

People invest in individual stocks. It's sad. They're cautious when they buy a refrigerator or a plane flight. They're watching their money. Then they hear about a stock on the bus and they put $5,000 to $10,000 into it and they have no idea what they're doing.

This approach can lead to buying overpriced companies that don't have strong fundamentals or long-term growth potential. Instead, focus on quality companies with good fundamentals and an interesting turnaround story.

Conclusion

Lynch's core message of "invest in what you know" is still relevant today. Investors should pursue companies and industries in which they have experience or a good understanding. In this way, they can more easily identify good investment opportunities and better understand the risks associated with investing in a particular company.

If investors are investing for the long term, they may find this advice useful. Most importantly, emotions do not belong in investing and should not be given any place in a portfolio. It is simply important to remain calm and look at companies rationally.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.