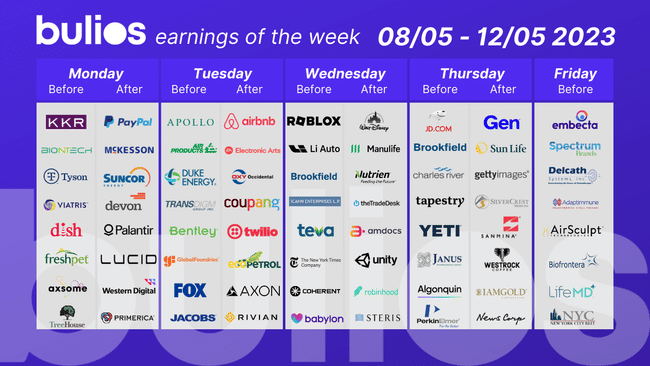

FAANG stocks may have already reported their results in recent weeks, but that doesn't mean we won't have something to watch. Next week, we have quarterly results from: PayPal, Palantir, OXY, Lucid, Airbnb, Roblox, and many more.

What do analysts expect from these companies?

PayPal $PYPL

PayPal is expected to report earnings of $1.09 per share for the current quarter, a year-over-year change of +23.9%. In the case of PayPal, the consensus revenue estimate is $6.97 billion for the current quarter, indicating a +7.5% year-over-year change.

Airbnb $ABNB

Earnings for the current quarter are expected to be $0.10 per share, which would be a huge increase from the prior year results of $0.03. Additionally, next quarter's earnings are projected at $0.87 per share, which shows how quickly ABNB is increasing its profitability.

However, revenue has begun to slow from the highs at the end of 2022. If revenue for the quarter is around the $1.8 billion estimate, it would mark the second consecutive quarter of slowing growth.

Occidental Petroleum $OXY

This oil and gas exploration and production company is expected to post quarterly earnings of $1.30 per share in its upcoming report, representing a year-over-year change of -38.7%.

Revenue is expected to be $7.54 billion, down 11.7% from the previous quarter.

Walt Disney $DIS

The estimate for Disney's Q1 earnings is $0.69 per share, which would be down -35% from Q1 2022 earnings of $1.06. Q1 revenue is expected to reach $23.33 billion, up 7% from the previous quarter. This reflects the fact that Disney continues to struggle with tougher operating conditions and broader economic challenges.

Palantir $PLTR

Expected to post a break-even profit and report revenue of $505.6 million, up 13.3% year-over-year.

Electronic Arts $EA

This video game maker is expected to post quarterly earnings of $1.32 per share in its upcoming report, representing a year-over-year change of +11.9%. Revenue is expected to be $1.73 billion, down 1.2% from the previous quarter.

Lucid $LCID

Lucid is expected to report a quarterly loss of $0.38 per share in its upcoming report, representing a year-over-year change of -660%!

Revenue is expected to be $158.4 million, up 174.6% from the previous quarter.

- Whose results do you care about? Let me know in the comments!

I am waiting for PayPal All time high.

I am interested in $PYPL and $PGNY. I would like to see some growth in PayPal.