PayPal results

We summarize a replay of PayPal Holdings Inc.'s conference call to announce the company's 1Q 2023 results

Before I get to those, just a little bit for those who aren't as familiar with it. PayPal Holdings, Inc. engages in the development of technology platforms for digital payments. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom and Paydiant products. It manages a platform that connects customers, consisting of merchants and consumers, and facilitates payment transaction processing. It allows its customers to use their account to buy and pay for goods as well as to transfer and withdraw funds. It also allows consumers to exchange funds with merchants using funding sources that include a bank account, PayPal account balance, PayPal credit account, credit and debit cards, or other stored value products. It offers consumers a personal payment solution through its PayPal website and Venmo and Xoom mobile apps.

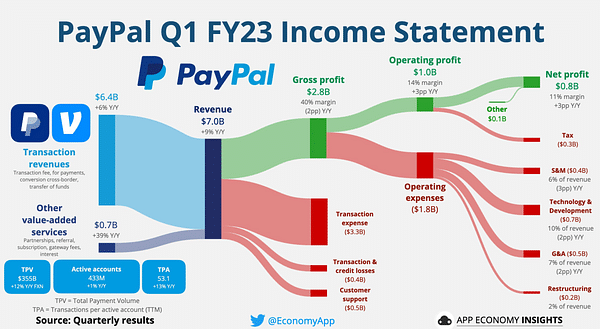

Now for the results. PayPal's financial report for the first quarter of fiscal year 2023 shows strong performance in several key metrics. Total Payments Processed Value (TPV) saw a 12% increase over the same period last year, reaching $355 billion. Net revenue of $7.04 billion. Indicating more activity on the platform and increased demand from users.

In addition, the number of active accounts increased by 1% to 433 million. This increase in active accounts also contributed to a 13% increase in transactions per active account. The company also reported a 9% increase in revenue over the same period last year, reaching $7.0 billion, beating market expectations by $50 million. This increase in revenue can be largely attributed to an increase in POS and a higher number of transactions. Non-GAAP adjusted earnings per share (EPS) were $1.17, an increase of 6% compared to the same period last year and beat market expectations. market by $0.07. This increase in EPS can be attributed to a combination of a higher number of transactions and effective management of operating expenses. As a result of the strong first quarter performance, PayPal raised its full-year FY2023 EPS forecast to $3.42 compared to the previous forecast of $3.27.

Overall, therefore, the company performed well on year-over-year numbers. Its officials assessed it as follows:

- "We are pleased with our first quarter 2023 results, which exceeded our expectations and validate the strength of our business and strategic decisions." - Said Dan Schulman, president and CEO of PayPal.

- John Rainey, PayPal's Chief Financial Officer and Chief Strategy Officer, said,"Our strong results are a testament to the success of our growth and innovation strategy, which focuses on customer needs and improving the experience of using our services."

- "We plan to continue to invest in technology that will improve the experience of using our services and enhance security. This is critical to our long-term growth and success." added Luis Garcia, PayPal's Chief Technology and Innovation Officer.

The company also said that they intend to keep improving their technology, they would like to focus more on digital services.

Despite the good news for 1Q the stock was down about 6% in non-trading time. Why such a big drop? I admit I don't know that much myself and I couldn't find specific news. There are different opinions on the internet and this is from a competitive perspective. After all, there are all sorts of new ways to make payments and so this industry giant has to keep investing in innovation and marketing. Further, for some investors, there are concerns about the company's plan to get more into the crypto world and thus connect services for this community as well.

Personally, I have the stock in my portfolio and have been waiting in anticipation of the growth that we have yet to see. I will use the downturn to buy. But I do believe in growth. Post in the comments what you and possibly if anyone has more information on the reasons for the stock drop.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

I'm watching Paypal, and although the share price hasn't reached my asking price yet, it was effectively close. The reason for the drop may be the margins, which are indicative of underperformance.

Thank you for the summary!