Feed

Great results from $SOFI sent stock prices down 12%! Is it because of the fall of the US bank $FRC?

Record GAAP and Adjusted Net Revenue for Q1 2023

GAAP net revenue of $472 million up 43%; Adjusted net revenue of $460 million up 43% year-over-year.

Adjusted record EBITDA of $76 million up 772% year-over-year.

New member additions of more than 433,000; Total members at quarter-end...

Read more

Zobrazit další komentáře

You've got to look at the negatives of the results, too, there's this to check out - The first is that SoFi reported 126 million accounts in the first quarter for its technology platform business, which allows companies to create financial services offerings, down from 131 million in the fourth quarter of last year.

The second thing is the fact that revenue beat analysts' estimates, but it absolutely didn't play with the outlook for the coming quarter and the rest of the year, which after all, logically they should have moved higher as well, but it didn't.

Zobrazit další komentáře

That's what foam looks like. I don't have a bank in my portfolio yet but I will probably consider buying a big bank eventually because after all, you can see how the big banks are doing and are still stable.

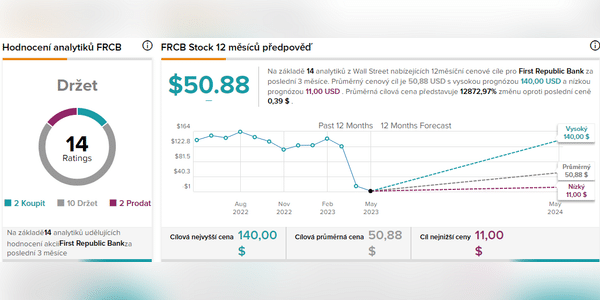

$FRC Bank admitted that it suffered intense deposit outflows of $100 billion during the SVB-induced turmoil and came close to collapse. Even worse and more troubling, management refused to take and answer analysts' questions during the earnings call. Shares of First Republic Bank are trading more than 40% lower today as troubling media reports about the company continue to...

Read more

The analysis at the broker is sometimes pretty random 😀. I don't think the stock can go up yet.