Bill Combs

Investors, what is your most profitable position in your portfolio and what % is it?

Last week I asked you what your most profitable position is, so today I'm asking you and you can tell me what your most profitable position is. In my portfolio, the most profitable so far is $AAPL over 40% and right after that $GOOGL slightly over 30%.

Zobrazit další komentáře

Investors, what do you think of Canadian National Railway's stock?

The company's stock has been rising for a long time, the company pays a dividend, the business is great and the company has a great competitive advantage too. I'm quite interested in this company and I would be happy to include $CNI stock in my portfolio, however the price is currently high and I would buy as low...

Read more

Zobrazit další komentáře

Interesting company, certainly rail in general is a great business, but how do you view being Canadian regarding dividend taxation? ...if you have like for growth I understand, but if also for dividends ... I have like this for example $ENB a super company in my opinion and also dividend, but I wonder if not to sell because I have a tax form with my broker for US stock only, but this is taxed I think 25% ...

Zobrazit další komentáře

Hi, I have exactly these three companies as well and buy relatively regularly. 😊

Shares of $BTI are down more than 20% this year and I am currently buying $BTI stock on a regular monthly basis as the current price is a great buy. For me, this is a great company with a great business and pays a very nice dividend.

Do you have shares of $BTI in your portfolio and are you overbought at the current price?

I recently opened an account with Fio and this week I plan to buy $KOMB.PR shares , however I am also very interested in $CZG.PR shares. Colt CZ Group shares look very interesting and I believe that the stock of this company will grow in the long run. I see low liquidity as a problem, but as a long term investor I am probably not that concerned.

What do you think about $CZG.PR?

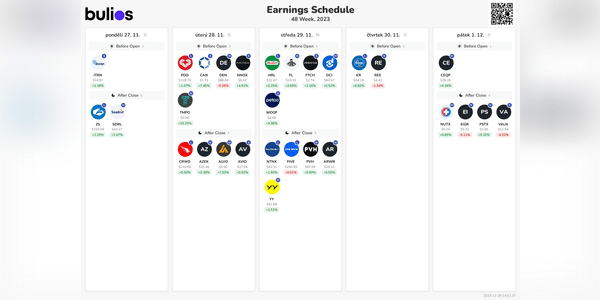

Medtronic is reporting the results tomorrow and I will be sure to see the results myself. I find this company very interesting and moreover, this company is in a sector where I see a lot of potential and I believe that the shares of companies in this sector will grow in the long term and solidly. As far as the share price is concerned, I currently find the share price quite...

Read more

Zobrazit další komentáře

I'll be buying a dividend stock like I do every month, I'm still figuring out which one.

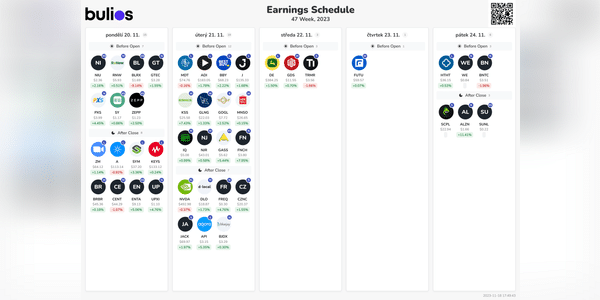

Investors, which company's results have surprised you the most so far?

I've been most surprised by ASML's results so far, because according to them, 2024 should not be so strong and revenues should be lower and in 2025 things should turn around and the company should start doing well again and the stock should go up again.

Zobrazit další komentáře

Interesting how in the US most of this sector has rather lower profits than last year

I see the most potential in WBD. I also like the management and their passion.