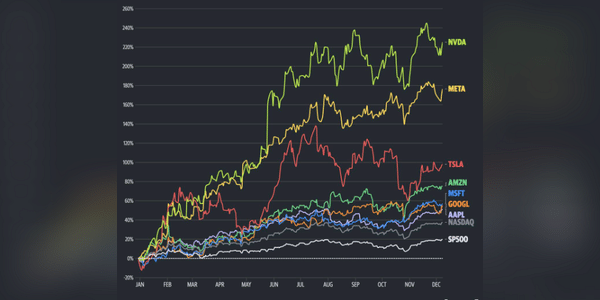

Investors, 2023 is slowly coming to a close, so I'd be interested to know what % your portfolio has appreciated this year.

I still have quite a few losing positions in my portfolio, but even so, my portfolio is up a little over 10% this year.

Bill Combs

Zobrazit další komentáře

I prefer not to get involved in for-profit car companies. The potential is high, but the environment is so competitive that I prefer to go only to the established giants.

What shares did you sell last time?

I last sold $MMM stock because I didn't like how many lawsuits the company was facing and the fines it had to pay. In hindsight, that may have been a mistake, but I won't be buying 3M stock again. Anyway, I hope I don't have to sell anything for a long time.

I've been looking at $KOFOL.PR stock now and I have such mixed feelings about it. Kofola is a great company, the current share price is not a bad buy and the company pays a decent dividend. However, I'm thinking that I can use the money to buy other stocks that will outperform or pay a higher dividend.

What is your opinion of $KOFOL.PR stock?

Zobrazit další komentáře

Moneta, KB, Vitesse Energy, Mercedes-Benz, Verizon, Société Generale, PKN Orlen ... my top two

Some time ago I wrote a status about Stellantis. I was very intrigued by the company, and of the automotive sector, I like this one probably the most. However, I still don't know at what price I should buy $STLA stock. The current price doesn't seem bad to me, but I'd rather buy below $20.

What do you think about $STLA stock and its price?

Zobrazit další komentáře

I'm not sure if we'll ever go there again, but I'm also set on buying $18. Even the current price seems great.

Investors, what % of your portfolio is currently cash?

I have recently bought a few stocks again and so cash is currently only about 10% of my portfolio, but I don't plan to buy much now so I hope to accumulate enough cash again.

Zobrazit další komentáře

I always have a cash reserve for about half a year of expenses and outside of about 25% of my portfolio I now have in cash. Respectively, saved so that including the cash reserve, interest was at least 6.25%p.a. and access was within 14days max

Investors, is there a stock you've liked this year that you've bought often and has become your favorite?

I have become very fond of $ASML, $CVS and $O this year. I see potential in all three companies and think there is quite a bit of room for growth in the stock. I've bought the aforementioned stocks quite frequently this year and they already make up a large part of my...

Read more

Zobrazit další komentáře

Zobrazit další komentáře

I see the most potential in WBD. I also like the management and their passion.

Investors, what is your most profitable position in your portfolio and what % is it?

Last week I asked you what your most profitable position is, so today I'm asking you and you can tell me what your most profitable position is. In my portfolio, the most profitable so far is $AAPL over 40% and right after that $GOOGL slightly over 30%.

Zobrazit další komentáře

Investors, what do you think of Canadian National Railway's stock?

The company's stock has been rising for a long time, the company pays a dividend, the business is great and the company has a great competitive advantage too. I'm quite interested in this company and I would be happy to include $CNI stock in my portfolio, however the price is currently high and I would buy as low...

Read more

Zobrazit další komentáře

Interesting company, certainly rail in general is a great business, but how do you view being Canadian regarding dividend taxation? ...if you have like for growth I understand, but if also for dividends ... I have like this for example $ENB a super company in my opinion and also dividend, but I wonder if not to sell because I have a tax form with my broker for US stock only, but this is taxed I think 25% ...

So the Patria app shows me a total of minus 31% which sounds scary at first glance, but you have to consider how it was created. First of all, almost all of the positions in Patria were created by profits from the sale of Tesla stock. When I switched from Savings Bank to CSOB. Tesla sales were at almost OTH and if I had been buying instead of selling at that time the minus to today would probably be even bigger.