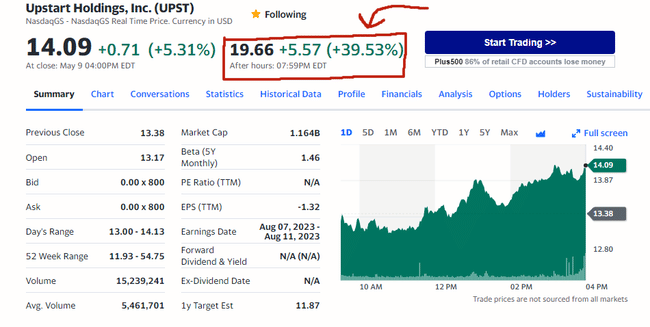

Upstart $UPST reported Q1/2023 results yesterday!

The results easily beat analysts' estimates and the stock jumped +40% in the aftermarket!

Earnings per share -0.47 vs. expected -0.826 (beat by 43%)

Revenue $102.927M vs expected $99.724M (beat by 3.2%)

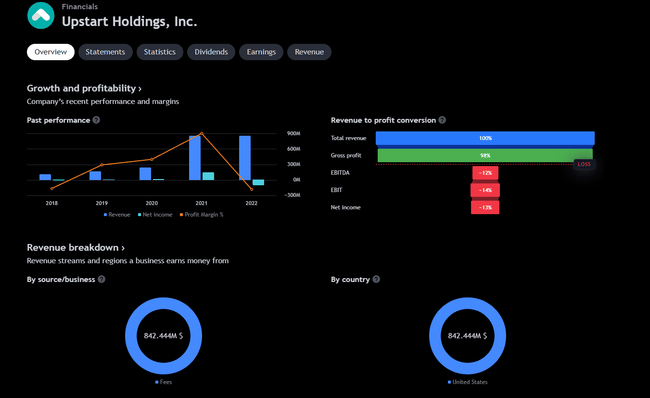

Net income is -13% which is not good.

Upstart only operates in the US so their only revenue is from this country. Each of the past five quarters they have had lower revenue and it continues to decline.

They've gone from $310M to the current $102M

This company works with banks and large corporations to sell software to.

It's artificial intelligence that evaluates non-standard data.

It looks at what you've studied or where you work and uses that to assess your ability to repay.

From a peak that was in 2021 at $400 that's a solid 96% drop (not including the +40% from the actermarket) to a price of $14. The stock will open higher today, but I wouldn't expect continued growth in the days ahead.

This company is not part of my portfolio, but they have an interesting product.