I would like to share this positive outlook with you. :)

Six signals that US stocks have passed the bottom of the bear trend and the rally can continue.

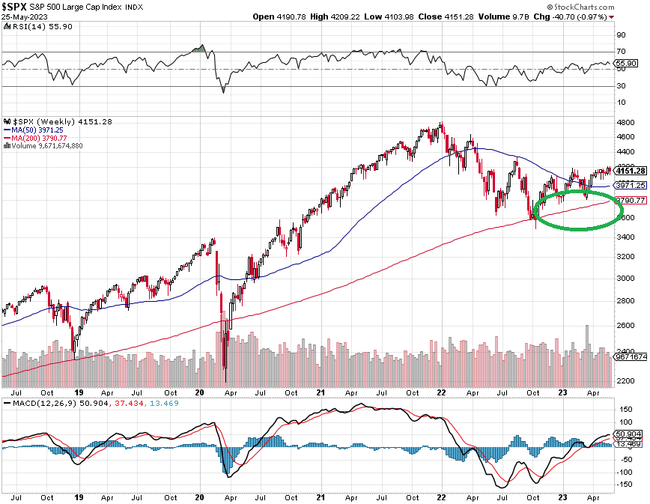

Strategist Thomas Lee of Fundstrat Global Advisors has been one of the biggest stock bulls for years. He didn't have it easy last year, but back in late April he published a list of arguments for the S&P 500 index not falling below last October's low and for the market to continue on its upward trajectory. And since the index has dutifully stayed roughly in the 4,050 to 4,200 range for the past month and has shown virtually nothing in aggregate, Lee's arguments are still valid.

Thomas Lee believes the U.S. stock market is not expensive. "The market bottoms 80% of the time before the fundamentals. And it's not out of place to mention that excluding the FAANG stocks, the forward P/E of the S&P 500 Index based on expected earnings in 2024 is only about 15. That's an interestingly valued market, with defensive sectors like essential consumer goods and services (P/E 19.6), network services (17.5), and health care (16.7) being the most expensive in this outlook," the strategist says.

And that's not all, Lee found half a dozen arguments supporting his bullish outlook for the U.S. stock market. He maintains a target level of 4,750 points for the S&P 500 index this year.

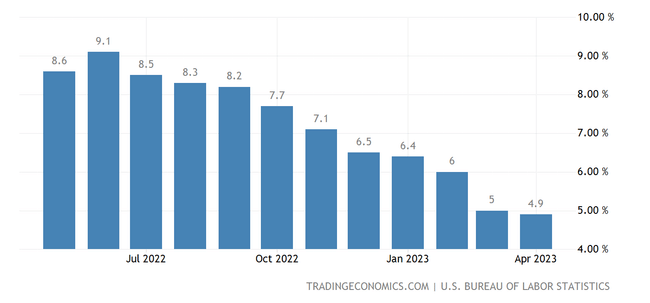

1. Inflation is coming off its peak (June 2022)

During past bear trends, the U.S. stock market bottomed around the time inflation peaked. It was 9.1% in the US last June, and is currently below 5%.

2. High yield bond spreads have peaked (July 2022)

Spreads on high-yield bonds (the difference in yields versus safe government bonds) typically peak before stock market lows.

3. First five days of the year rule (January 9, 2023)

Since 1950, there have been seven times that the S&P 500 Index has gained more than 1.4% after a loss the previous year after five trading days of the year. Each time, the entire calendar year has been positive. This year, the S&P 500 index added only 1.37% in the first five days, but even after gaining at least one percent in the first few days of the year, the statistics for the entire year are clearly bullish, with the S&P 500 closing the year higher 87% of the time and gaining an average of 15%.

4. Two profitable quarters in a row for the S&P 500 (March 31, 2023)

Since 1950, the S&P 500 Index has never risen two quarters in a row when it then continued a bearish trend in terms of falling to new lows. Moreover, when the index has added at least 5% in both quarters, it has been in the black 87% of the time on an annualized basis with an average gain of 13.5%.

5. S&P 500 Index more than 15 weeks above the 200-week average (January 2023)

Since 1950, the index has climbed above its 200-week average for at least 15 weeks a total of 12 times and never since then has fallen to new bear trend lows.

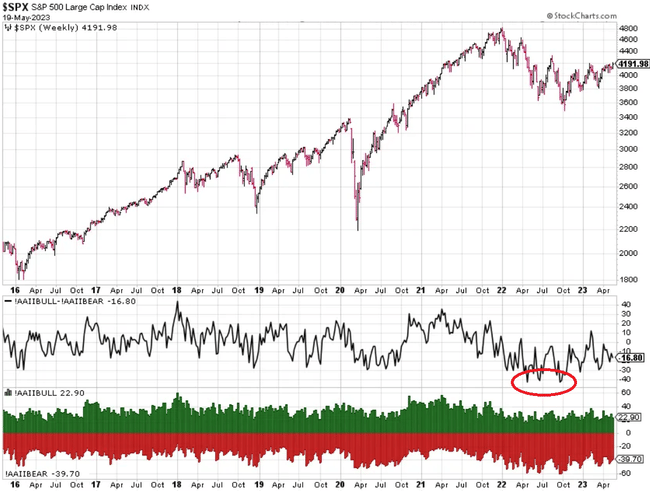

6. Extremely bearish market sentiment (year 2022)

Over the past year, the gap between the bear and bull shares in the American Association of Individual Investors survey has widened extremely several times. This is only the third time since 1987 that the market has seen such a significant preponderance of bears. It occurred in 1991 and 2009, each time after a major stock market bottom and at the beginning of a bull run.

Great, nice information, it would be so nice. Although I'd still like to give the cash I'm holding 🤦♂️ ...and also as Christopher says, I'd be careful what I've learned over the year, that if you talk too much about something and get crazy about it, then there's a quick turnaround.

Sure, something is warranted and the market may well break out to new highs, but despite this I would still be wary and not get caught up in the wave of the rise. Always caution.

Great, thanks for the nice summary and new information :)

Nicely written, maybe there's something to it.

Nicely written, maybe there's something to it.