Shares are (in)expensive. It's just me with little money! :)

Stocks can be cheap and expensive at the same time. It depends on what you relate their price to, what segment of the stock market you are talking about, or what averages you are comparing current valuations to. What can be gleaned (among other things) from valuation multiples at the moment?

US stocks

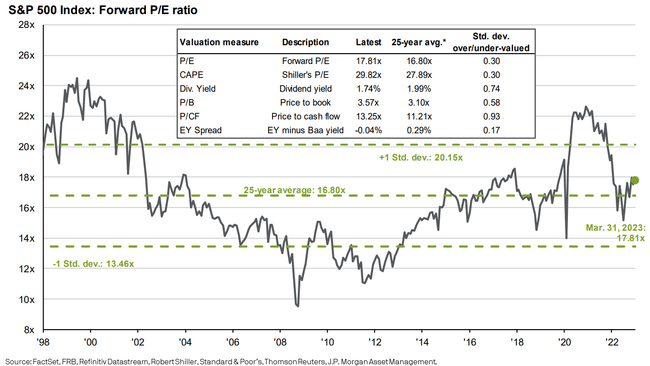

US stocks are currently neither downright expensive nor downright cheap in terms of most valuation multiples. The P/E of the S&P 500 is below 18, with its 25-year average at 16.8. The Shiller cyclically-adjusted P/E ratio is less than 30, when the 25-year average is 27.9.

Stocks outside the United States

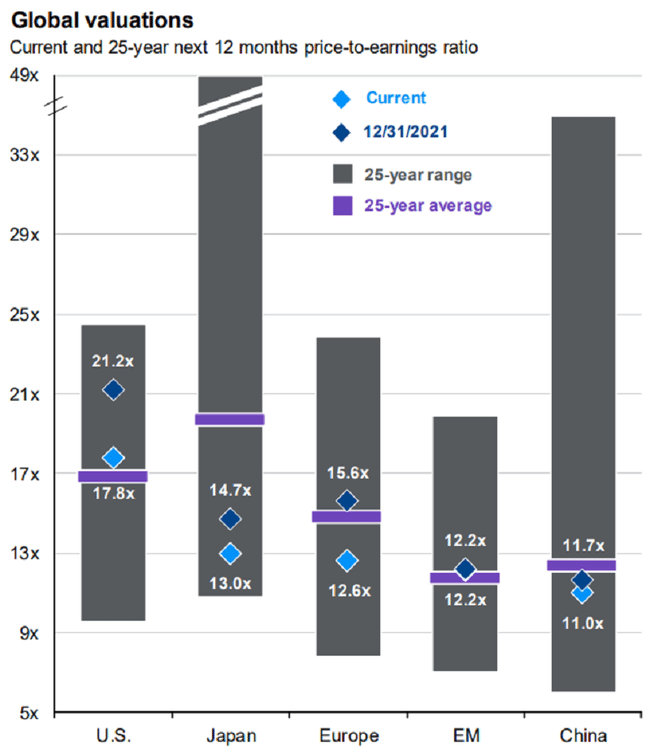

The valuations of emerging market equities do not show significant deviations from their long-term averages. Japanese as well as European equities continue to appear interestingly valued. European and Japanese P/Es now stand at 12.6 and 13, respectively, while the averages over the past 25 years are roughly 15 and 20, respectively.

What about you and the P/E ratio? What weight do you actually give it?

P/E is a small piece of the puzzle for me. Of course, I like it better when it is low, but $AMD, for example, proves that we must not cling to this indicator.

I'll definitely look at the P/E, but it's not worth that much to me.

He's gonna find out what kind of company this is. Somewhere, a higher P/E may indicate higher growth potential or higher expectations for the future. On its own, P/E is useless to me, I always need other data and indicators to understand exactly why it is at a given level.