Here's Nvidia's Sunday look at AI and tech-AI stocks in general...

NVIDIA: Risk of extremely optimistic outlook could hit entire AI-related sector

Shares of artificial intelligence (AI)-related companies in particular have been gaining in the U.S. market this year, but the U.S. government could put a stop to that rather quickly. This is because it is considering extending export regulations that restrict the export of AI chips to China from October 2022. NVIDIA's shares reacted to the news by falling, and the same may be true for other tech titles.

Geographic revenue distribution data shows that China was by far the biggest driver of Nvidia's strong revenue growth in Q1 FY 2024 (as of 30 April 2023). This is because Chinese tech firms are trying their best to catch up with their US counterparts in AI technology. Thus, the extension of export regulations to AI chips currently poses a significant risk to Nvidia's extremely optimistic outlook published in May.

The Biden administration is considering new export restrictions on AI chips

The Wall Street Journal reported in late June that the US government is considering further restrictions on AI chip exports, so NVIDIA would most likely have to apply for permission to sell to specific customers in China. The Journal mentions that the US Department of Commerce is expected to make a decision on the matter in early July. This shortened deadline suggests that the US is worried that China will do everything in its power to catch up with the US lead in AI technology. The share prices of Nvidia, but also AMD, reacted to the news by falling.

China is the key driving force behind Nvidia's promising outlook

The rise of US stocks due to the sudden popularity of AI is one of the key sources of revenue this year, so new export restrictions may have a major impact on market sentiment. Nvidia's promising outlook, published on 24 May as part of its 1Q2024 earnings report, has lifted prices for the entire stock group and driven 12-month earnings expectations for the entire S&P 500 technology sector substantially higher ahead of the important Q2 earnings season that starts in mid-July.

If we want to understand the significance of these potential new export restrictions facing NVIDIA and AMD, we need to go back to October 7, 2022, when the Biden administration imposed restrictions on the export of advanced U.S. AI and semiconductor technologies to China. This regulation was intended to prevent advanced chip manufacturers like NVIDIA from exporting A100 chips to China. Over the next four trading sessions, Nvidia shares fell a total of 12% as investors realized that the new regulations directly threatened roughly 26% of the company's business.

A month later, reports emerged that NVIDIA was working on a solution that would allow it to export AI chips to China again, as it would comply with the newly imposed restrictions. Its codename was A800, and according to its latest filings with the SEC (10-K), the A800 and H800 chips are intended to be a replacement for the successful A100 and H100 AI chips for the Chinese market. The main change was that NVIDIA limited the speed of its high-speed NVLink bus to 400 GB/s. This opened up the Chinese market where it could sell the new AI chips without seeking permission.

Catching up with the US

Demand for the A800 and H800 chips has increased significantly, mainly due to purchases by Tencent and similar Chinese technology firms. This corresponds to a situation where China is lagging far behind US firms in AI, and the launch of ChatGPT and the Bard product has fueled its desire to catch up with the US. The Chinese media has been talking about the government's intention to significantly increase investment in R&D this year, and according to Bloomberg, China can be expected to spend up to $15 billion on AI this year alone.

The explosive growth in Chinese demand is clearly evident, even if we take a closer look at the geographic distribution of Nvidia's sales. Nowhere in its press releases or investor presentations does it mention China or cryptocurrency mining, intentionally. To find out the geographic breakdown of its revenues, we need to delve deep into its regulatory filings. They make it clear that in 2022, revenues in China and Taiwan fell because mining cryptocurrencies was not nearly as profitable as it used to be after the cryptocurrency price crash. The market was flooded with NVIDIA GPUs, which were no longer used to mine bitcoin and other cryptocurrencies.

Another interesting fact is the rapid decline in Chinese revenues in the quarter ending 29 January 2023, although the cryptocurrency market has already stabilised. We assume this is due to the new export restrictions introduced on October 7, 2022. At the same time, we have seen an increase in revenues from other countries in the same quarter. We know from the latest reports to the US regulator (SEC) that the largest country in this segment is Singapore, which is now listed separately and could therefore be used as an intermediary for the sale of A100 and H100 chips.

Really electric cars?

In 1QFY2024, ending 30 April 2023, we see that China's sales grew 67% quarter-on-quarter, while the US market strengthened only 7% despite being the AI hatchery. No wonder NVIDIA published such a promising outlook. Other countries then fell 31% quarter-on-quarter. Curiously, despite the massive growth in Chinese sales, NVIDIA mentions China only once in its entire earnings report and investor presentation, and then only in a small footnote under the automotive segment that says "some customers producing NEVs in China are adjusting their production schedules to reflect slower-than-expected demand growth."

Putting this information together, it appears that there is significant demand for the new A800 and H800 chips in China as Chinese tech firms try their best to catch up with their US counterparts in the AI space in compliance with government regulations. The fact that the U.S. Department of Commerce is considering changing export rules, then, shows that the U.S. government has noticed this trend and is worried about what it means for U.S. leadership in AI technology.

The new export restrictions are by far the most serious risk for Nvidia shareholders at the moment, as the necessity of permitting the export of AI-related chips would have a significant negative impact on the company's financial results, as seen in its filings with the SEC. If the U.S. government does indeed impose new export regulations for AI chips, it could take the wind out of the sails of the stock prices of AI-linked companies. Across the US tech sector, investors would likely start to reduce risk and funds would reduce exposure and take profits.

The fragmentation game won't escape Nvidia either

The world is beginning to play the so-called fragmentation game, which is a sort of extension of the trade war launched by the Trump administration in 2016. The term fragmentation game refers to geopolitical dynamics based on the idea of minimising risks in global supply chains. Europe initially tried to play it neutral, but Russia's invasion of Ukraine threw it into the fragmentation game full throttle. The whole game has four basic pillars - defence, energy, commodities and technology.

If AI technologies are going to be the most important technology area in the coming decade, there is no way NVIDIA can continue to pursue a neutral business strategy that only maximizes shareholder profits. It will have to strictly follow US industrial and national security policies in AI technology. Given that current expectations are largely shaped by Nvidia's latest outlook, which relies heavily on Chinese technology firms catching up with their US counterparts, the US government's potential decision to impose new restrictions on AI chip exports to China poses a serious risk to the company.

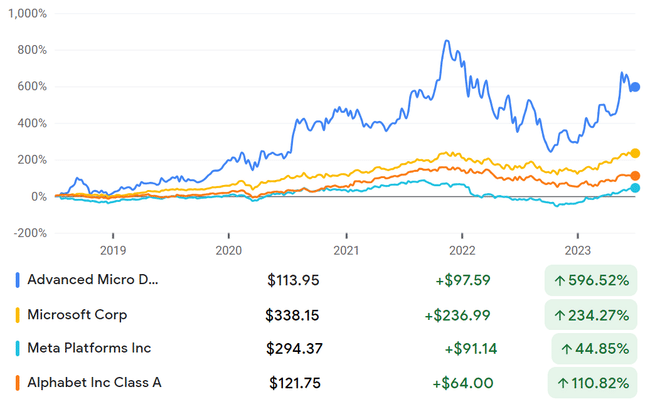

Investors who hold Nvidia stock, and U.S. technology companies in general, in anticipation of further big gains should consider de-risking their portfolios and possibly reducing their exposure. We currently see maximum expectations around us, which the fragmentation game can mess with badly. The negative regulatory impact on Nvidia is likely to extend to the rest of the "AI cluster", which includes stocks of AMD, ASML, Adobe, Alphabet, Meta Platforms, Advantest, Palantir, Marvell Technology, Microsoft and Applied Materials, to name a few.

What do you think? :)

Maybe someone can help with the current AI stock valuation overview on FASTgraphs https://youtu.be/vYhzNQ64SlM