Have a nice Wednesday, my friends.

I'm not going to write any direct news today, rather I just want to give space to discuss how you think this first busy week is going so far and JPMorgan's outlook for today's Fed meeting, which I'm sure we will all be watching closely. 😊

This week is really full of everything in the investment world and everyone you know here certainly has something we are watching closely. Listing it out is probably not really essential, just for example I have like 15 companies this week that I am at least interested in seeing how they are doing. 😊 Yesterday, as mentioned here, $GOOG pleasantly surprised $GOOG, which especially with its YouTube division is doing nice numbers and showed that it definitely has room to grow. For that $MSFT will take a loss in price today according to the pre-mark, but from its highs I take it more as just a correction and nothing to worry about as a long term investor.

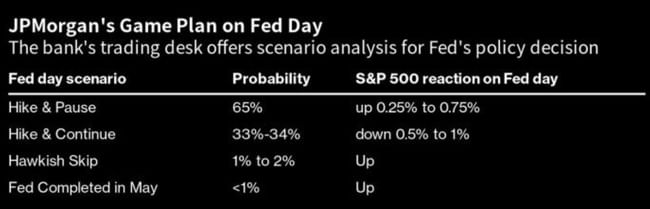

But what a nice chart I came across for today's Fed meeting from JPMorgan and their analysts. $JPM

As we can see, and it's not hard to translate for non-English speakers, the assumption according to the company is a 0.25 point increase today. Which doesn't come as news to those of us watching this, it's pretty much in the expectation, but it will be rather interesting to see how the Fed handles the next outlook. Personally, I think there will be a pause after that as well, with the conference saying roughly words like, "We're going to watch the numbers, the economic results, and then we'll see if this is the last hike or if we're going to have another one before the end of the year." If this scenario occurs as even analysts are leaning from 65%, we are likely to see more green days ahead thanks to the results of the big companies. 🍀

I generally see this year as a pleasant surprise, where at least the indices have already given back what they took from us after the crash in 2022 and the Fed, after its start by regularly raising interest rates, is so far fighting inflation unexpectedly well even for many without hitting the economy more, without disrupting the labor market or major asset classes (stocks, housing, corporate credit). Thus, so far, even the oft-mentioned recession is being delayed.

Enjoy the two weeks of full results now and don't be afraid to post what surprises you pleasantly or unpleasantly in the markets. 😊

Great, nicely written again. I'm also interested in the results of a few companies and the Fed didn't surprise in the end and raised interest rates by 25bps. I'm really enjoying this week😁.

Nice info, thanks :)

great

Thanks for the report, I was looking at $MSFT yesterday and the results just don't look that bad to me. Today the dividend giant $BTI announced their results for me they surprised me a lot, I still have to look at the announced divi. We'll see about the Fed today, I rather expect a 25bps hike and then a pause.

Surprised me so far $MMM. I didn't expect them to do so well