💼💹 Bank JPMorgan $JPMusalong with other US banks today announced results for 4Q 2023. For the quarter, it reported net income of $9.3 billion ($3.04 per share). For the full year, net income is $49.6 billion ($16.23 per share). That's a decent chunk of change, which is part of why it's the largest bank in the US. Buoyed by better lending margins and the acquisition of failed...

Read more

Feed

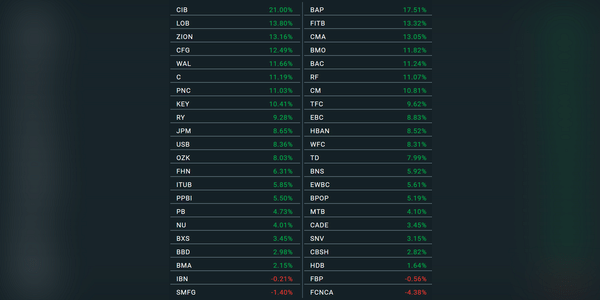

Shares of US banks have been rising solidly recently. Shares of $BAC are up about 12% over the past month and shares of $JPM are up about 9%. I've been buying quite a bit of $BAC stock around the $28 price and the current growth and appreciation obviously makes me happy.

Which bank stocks do you have in your portfolio and what is the appreciation on them?

Read more

Zobrazit další komentáře

We were discussing banks recently over a post and it didn't even take long, it makes me happy.

Zobrazit další komentáře

Zobrazit další komentáře

Either he must be doing very well or not at all :D but judging by the latest results, he's probably doing rather well :)

Zobrazit další komentáře

Great, nicely written again. I'm also interested in the results of a few companies and the Fed didn't surprise in the end and raised interest rates by 25bps. I'm really enjoying this week😁.

Last week we started with the results of the big banks, today the continuation in the form of Bank of America. $BAC

Another one of the biggest US banks and Warren Buffett's favorite bank unveiled its results and they were above expectations. The bank jumped a percentage point higher in pre-trading hours.

Read more

Zobrazit další komentáře

I recently bought shares of $BAC. I looked at the results and I have to say that I was pleasantly surprised by the results.

Have a nice day😁.

Zobrazit další komentáře

Whose results will you be watching this week? For me, it's definitely JPMorgan $JPM, which I continue to hold in my portfolio. Analysts here are expecting year-over-year earnings per share growth (about 30%) and sales up about 20% from last quarter. That doesn't look bad at all, so I'm hoping it turns green on Friday.

Giant US banks have passed the Fed's stress test.

The five largest U.S. banks said Friday they will return more cash to shareholders after passing the Fed's stress tests early last week, a show of strength that reinforces the gap between the industry giants and smaller regional rivals.

Read more

Zobrazit další komentáře

Amazon $AMZN will expand its mobile phone offerings for Prime members.

Apple $AAPL will offer high-yield savings accounts.

JP Morgan $JPM now controls more than 15% of US bank deposits.

Google $GOOG now controls more than 90% of global search traffic.

Meta $META just announced that it has 3 billion active users across all of its platforms.

A few companies now control almost...

Read more

Zobrazit další komentáře

I guess it depends, what's "crumb"? At least for me it's wrong that there is an unassailable monopoly in every segment...

Zobrazit další komentáře

It's definitely interesting. I would take it as some new information, but I probably wouldn't rely on AI alone.

Zobrazit další komentáře

That's what foam looks like. I don't have a bank in my portfolio yet but I will probably consider buying a big bank eventually because after all, you can see how the big banks are doing and are still stable.

Banking great and expecting a good year, I have my reps in my portfolio.