JPMorgan

Fair Price

Profile

Feed

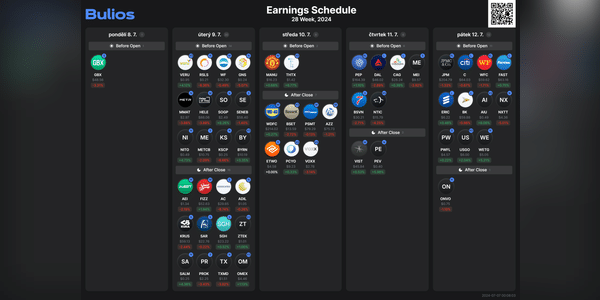

🗓️Klíčové events of the coming week!

This week there are interesting conferences, news in AIbut also at Robotax. In this busy week, we start the results season, which will be kicked off by PepsiCo followed by the largest banking house in the United States!

Let's keep a close eye on these events!

🧠Monday: $NVDA AI Summit - NVIDIA is one of the leaders in AI chips. From data...

Read more

Zobrazit další komentáře

Well, I have to say that the results of the banks made me happy. Now I will be interested in the results of $BAC, as I have their stock in my portfolio.

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Hey, guys,

We all have some diversification in our investment portfolios, like the technology sector ($GOOG, $NVDA) or banking ($JPM, $BAC) and other various sectors...

I would be interested to know if anyone invests in bonds, for example, and if so, where and how they do it.

Roughly how much cash do you try to hold (as a % of your portfolio)?

So I personally hold the most cash...

Read more

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Shares of $JPM

JPMorgan Chase & Co. is one of the largest financial institutions in the world, headquartered in New York City. The firm is known for the banking, investment and financial services it provides globally.

The stock is up 17% YTD. Today, the stock is trading at around $201. Analysts have a 12-month price target set at around $224.

...Read more

Zobrazit další komentáře

📊 US banks under pressure: Recession fears shake the market!📉

US bank stocks are losing ground, a direct result of growing fears of a possible recession. Investors are turning to safer assets, fleeing a sector that is closely linked to the state of the economy.

Citigroup $C, along with Wells Fargo $WFC, recorded the biggest loss over the past five days by more than 13 %, followe...

Read more

Zobrazit další komentáře

All I have from the US is $BAC. If one buys shares of those big banks, I don't think one has much to worry about. I would be much more afraid of the small ones.

📊✨ Today's results for Citigroup, JPMorgan Chase and Wells Fargo for Q2 2024!

Citigroup $C

Released financial results for Q2 2024. Net income reached $3.2 billion ($1.52 per share) on revenue of $20.1 billion. By comparison, in Q2 2023 , net profit was $2.9 billion ($1.33 per share) on revenue of$19.4 billion. This growth was supported by strong performance across the US banking...

Read more

Zobrazit další komentáře

🗓️Klíčové events of the coming week!

Earnings season starts again this week and as usual the biggest banking houses in the USA along with PepsiCo. Here is a summary of the interesting events that are coming up and that may influence the markets.

👨⚖️Tuesday: Chairman Fed Chairman Jerome Powell will be speaking before Congress on the state of the economy and monetary policy. Key...

Read more

Zobrazit další komentáře

Again a great summary and opinion on the banks, I think they will be good numbers too, after all they are benefiting from ever higher rates. I hold $JPM long term and am very happy, I have nice numbers there and will continue to hold, I don't expect a drop.

Zobrazit další komentáře

But this one got away, it was here a while ago and another quarter is already over :) Definitely the end of the week - banks.

📊 What is the current state of the financial market? JPMorgan's Jamie Dimon shares his thoughts and concerns in his recent letter to shareholders. 🏦

🔍 Dimon highlights the risks associated with inflation and interest rates that could be higher than markets expect. Global events are impacting markets around the world. 🌍

💼 Big government spending, efforts by the Federal Reserve to...

Read more

Zobrazit další komentáře

JPM is a great company and has great management. I'm kind of sorry I didn't buy last year.

📈 This week we have several key events that may affect the markets! 🌍

Here's my list of highlights and events I'm waiting for. The most important, however, is the start of the next earnings season, which is traditionally kicked off by the biggest banking houses in America.

The start of the week won't be very interesting, but things will get going onWednesday . In the US , we'll...

Read more

U.S. bank JPMorgan $JPM reported fourth-quarter fiscal 2023 net income per share of $3.04. It then generated record earnings per share of $16.23 for the full year. Historically, it was the most profitable year for $JPM, with the bank making a profit of $49.6 billion. Will this year be even better for me?

In the end, the banks had great results, but I'm still waiting for the $BAC results.