Bill Combs

Shares of $MC.PA are down about 15% over the past year and the current price is not a bad buy for me at all. I've already bought a little and if the stock keeps going down I'll be overbought.

Are you buying shares of $MC.PA at thecurrent price?

Investors, what do you think of $BLKstock ?

I've been reading quite a bit about this company and their stock lately, and I'm quite intrigued by the company, however, the stock currently strikes me as expensive. I will be glad if you can possibly write me how you see the price and at what price you are buying.

Zobrazit další komentáře

I've also read a little bit, although not enough to form an opinion on whether the price is high, except that it is one of the more expensive ones per share, but given the potential growth, I have no idea...

Interactive Brokers is reporting results today, and I have to say I'm quite interested in their results. Even before I looked at the chart I was expecting their stock to not grow much, but it's not that bad, however, it's not a stock I would want to include in my portfolio.

Anyone have $IBKR stock in their portfolio?

Zobrazit další komentáře

The result was not bad. I don't own the stock, but I just checked it out for interest;)

Yesterday I mentioned $TMUS stock here and following that I would like to ask you for your opinion on the company and Vodafone stock.

The company does pay a very nice dividend, but $VOD stock has been declining for a long time and I don't like that at all and I would not include the stock in my portfolio.

If anyone has VOD stock in their portfolio, I'd be happy to hear from you...

Read more

Zobrazit další komentáře

I like the divi there, but I have a feeling that longhobe is losing clients or am I wrong?

T-mobile recently partnered with SpaceX and $TMUS stock has been rising pretty solidly over the past year. This collaboration could bring more profits to T-mobile and the company could do better. Plus, the stock price right now is not a bad buy for me at all.

What do you think about $TMUS stock?

I've been thinking for a while about including a particular ETF in my portfolio from an area that I don't really understand, or where I find it better to put money in multiple stocks rather than one.

Do you have any ETFs in your portfolio, perhaps from just one sector, and if so, which ones?

Zobrazit další komentáře

Why would I want to expose myself to an area I don't understand? That's like boldly going into a test I didn't prepare for and expecting something other than a 5 in the result :D

Investors, what do you think of $CRWD stock ?

$CRWD stock is up about 150% over the past year. I would very much like to include shares of this company in my portfolio as this company is in a very interesting and important sector, however the stock is currently expensive and I would buy up to under $180.

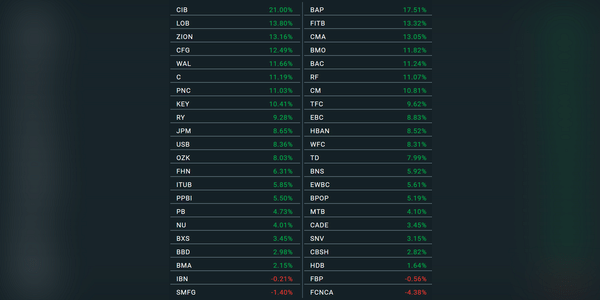

Shares of US banks have been rising solidly recently. Shares of $BAC are up about 12% over the past month and shares of $JPM are up about 9%. I've been buying quite a bit of $BAC stock around the $28 price and the current growth and appreciation obviously makes me happy.

Which bank stocks do you have in your portfolio and what is the appreciation on them?

Read more

Zobrazit další komentáře

We were discussing banks recently over a post and it didn't even take long, it makes me happy.

I see that $BABA stock is down over 20% in the last year and even though it is a Chinese company I am considering buying it. However, this stock is not that important to me and I would buy shares down to below $72.

Do you have $BABA stock in your portfolio and at what price are you overbought?

Zobrazit další komentáře

Yeah the drop to $INTC was decent, but I certainly wouldn't buy at the current price and would rather see a price to buy somewhere between $26-30.

I don't, do they have anything interesting in testing right now?