Bill Combs

Investors, what do you think of the $DISresults ?

The results were very positive and Disney announced a partnership with EpicGames. The stock jumped about 12% after the results. I have to say I've been a little pessimistic about Disney lately, but I'm happy with the results and I'll be holding the stock for a long time.

Zobrazit další komentáře

Precious on what basis?

I sold CAT in late 2021 and early 2022 when the P/E and F/PE seemed too high (25 and 20) at $212 and $224 with nice appreciation.

Since then, however, they have made nice gains and are at about 18 and 15 on both metrics, which is below the 5y average and slightly above the 10y median. On most indicators they are realistically -10-20% below the average (and even the sector they dominate).

The growth is assumed to be about 12.5% so the PEG is below 1.5. I've gradually sold off most of the highly cyclical stocks, so that's the only reason I haven't bought them back, otherwise I wouldn't hesitate and certainly wouldn't wait for some token amount of 300 or below my average etc.

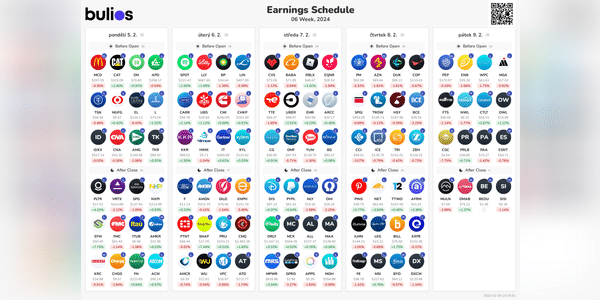

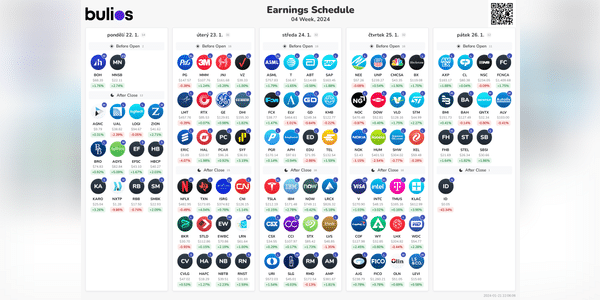

Last week was probably the most interesting in terms of results, but this week is still interestingfor me and there are some big and interesting companies reporting results. I will definitely be interested in the results of$CAT, $CVS, $DIS and $PEP.

Which company's results will interest you this week?

Zobrazit další komentáře

Investors what do you think of $SPOTstock and at what price would you buy?

Spotify is a great company and I love using its services, but I don't have shares of the company in my portfolio and probably don't want to. If the stock gets below $150, I might think about buying it, but I would just take it purely as speculation.

I see that $INTCstock is down about 14% this year. Intel is an interesting and great company, but I already have other stocks in my portfolio from this sector and INTC stock is quite expensive. If the stock gets below $30, I might think about buying it.

At what price are you buying $INTCstock ?

Investors, how many positions do you currently have in your portfolio?

I currently have 15 positions in my portfolio not counting ETFs and I want to keep it between 15 and 20.

For me it's $ENPH 10.4%, $O 8.2%, $BATS.L 7%, $CVS 6% ...and then the next one is more around 4-5%