Today I was looking at a comparison of different brokers and the fees they charge. I prefer XTB and so far it suits me probably the most + for Czech stocks I have a portfolio with Fio.

Which broker do you use?

Today I was looking at a comparison of different brokers and the fees they charge. I prefer XTB and so far it suits me probably the most + for Czech stocks I have a portfolio with Fio.

Which broker do you use?

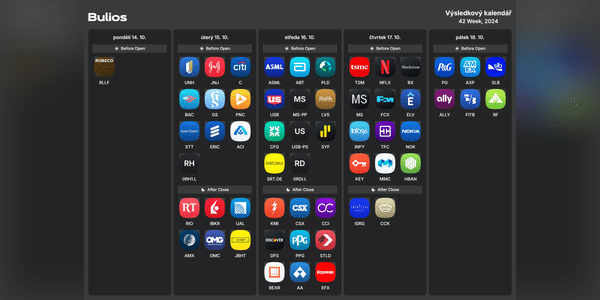

Next week will be very interesting in terms of company results. I will be most interested in the results of $BAC and $ASML, as I have these stocks in my portfolio. But I will also be interested in the results of $TSM, $UNH and $NFLX.

Which companies will you be most interested in next week?

I was a little bummed about $ASML, but it's still a great company and it doesn't change my opinion of the company.

Yesterday he reported his results and Black Rock and the results were very good. I have had this company on my watchlist for a while now and I would like to include their stock in my portfolio. But the price is still pretty high. I would start thinking about buying below $800.

At what price do you buy $BLKstock ?

It would be nice for the stock to fall one more time that way. Below that $200, I'd start thinking about buying.

Trump is crazy, I don't like Kamala's thoughts and actions. In the end I may not care if Trump or want to fight.

It's probably too stable a stock for me. If I want a dividend stock in my portfolio, I will definitely choose another stock.

How big of a fee is acceptable to you from a broker?

I started investing with Porto at the very beginning, but over time I found out that there is a 1% fee, which makes a terrible difference in the long run and it is a shame to lose that much money. So I then switched to XTB and fortunately there the fees are zero.

I agree, the 1% charge is already visible and it's noticeable. There are plenty of brokers that have small or almost zero fees. Especially the difference is really big in the long run.

It's too big a risk for me. The stock is very volatile and the financials look scary too.

For me, the current price is pretty cool, but I probably won't be buying. I might be much more interested in $SQ stock.

I recently came across a company called MercadoLibre. Their business is quite similar to Amazon. Overall, the company has been quite successful and profitable in recent years. It might not be bad for a smaller position, but the price is pretty high right now.

What's your take on MercadoLibre ($MELI)?

Now with a new CEO, things could turn around and it might not be a bad idea to buy a few shares on speculation that the stock will rise again.

It's horrible and the important thing is the reason why the stock is falling. European car companies are not doing well and it's a risk to invest now.

I was going through my portfolio today to see which stocks I want to sell because I would like to get rid of them and create some open positions. If the stock takes a profit, I would like to completely sell off $PFE and $DISshares .

Which stocks in your portfolio do you no longer want and would like to sell?

I'm thinking a lot about selling $CVS. They're not doing well at all anymore, but I'll probably wait and if the position turns a profit, I'd probably sell.

I think trading212 is great. It fulfills everything a quality broker should offer.