Last week, Apple's new savings account raised nearly $1 billion in four days. Robinhood immediately responded to the situation and increased the interest rate on its savings account. While traditional banks are struggling, these giants are making solid profits. With mobile apps and huge reach, tech giants can offer irresistible returns and pull in bank customers. But for banks, this poses an existential threat! The battle for deposits has just begun.

Apple $AAPL'scontinued push into financial services could cause problems for regional banks struggling to hold onto deposits amid recent banking system woes and rising interest rates.

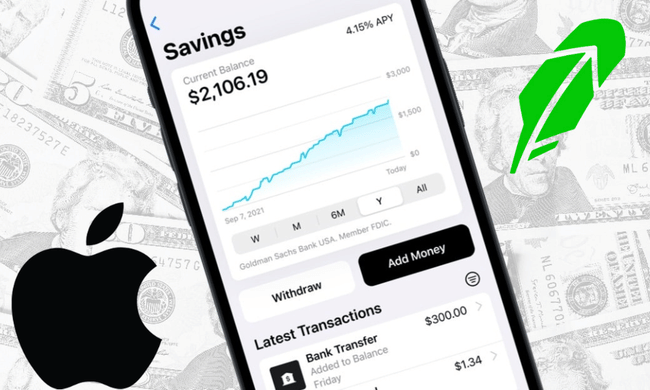

Last month, Apple launched its own savings account that allows Apple Card users to deposit their funds into a Goldman Sachs savings account that offers an annual interest rate of 4.15%. Anticipation for this product has only grown since its announcement in October.

But Apple isn't the only tech company offering unconventional ways to save and earn money. Online broker Robinhood $HOOD on Thursday raised rates for its savings account to 4.65% annually.

In recent weeks, some people have become wary of depositing money in U.S. banks as the fundamentals of the banking system have recently proven to be the weakest since the global financial crisis. And we all know how to say it: A bank's biggest vulnerability is a loss of confidence.

So Apple's timing turned out to be perfect. Consumer trust in the brand is unparalleled. People are actively seeking the best high-interest savings accounts, and Apple's new savings account option attracted nearly $1 billion in deposits in the first four days; $400 million in the first day!

Since March, concerns about unrealized losses on the balance sheets of regional and mid-sized banks have caused an outflow of deposits at many of these banks. Amid three regional bank failures and the takeover of 166-year-old Credit Suisse by Swiss rival UBS, median deposits fell 3% and 2% at nine key regional and 23 mid-sized banks tracked by Wedbush Securities.

Uncertainty around regional banks persists. Shares of banks like PacWest $PACW, Western Alliance Bancorporation $WAL and Zions Bancorp $ZION have fallen dramatically since the beginning of the year.

Meanwhile, Apple's move builds on the Apple Pay feature from 2014. It was followed by Apple Cash in 2017 and Apple Card in 2019. Then earlier this year, Apple introduced Apple Pay Later, a feature that provides loans.

By traditional standards, Apple is not a bank. But it's starting to look like one. Apple believes in the value of ownership of the relationship between consumers and retailers. And thanks to the reach of the iPhone, it has that necessary infrastructure. After all, to get an Apple savings account, you need an Apple Card account, which means you need an iPhone. There are more than 2 billion iPhones on the market, and iPhone users touch their devices an average of 2,617 times a day.

The interest rates currently offered by Apple and Robinhood far exceed those of most traditional banks. In April, U.S. savings accounts earned an average of just 0.39%, according to data from the Federal Deposit Insurance Corporation (FDIC).

Some depositors may worry that emerging accounts will not provide the same regulatory deposit protection as FDIC-insured bank accounts. This is true for PayPal and Venmo balances, although the FDIC protects balances in those accounts that are derived from direct deposits through payouts or government benefits.

Because Goldman Sachs services Apple's accounts, deposits of up to $250,000 in those accounts qualify for FDIC protection, just as they do for banks, which is key.

While it is noteworthy that the FDIC also insured deposits at three recently failed banks and regional and mid-sized banks that are now suffering from declining deposits. However, accounts that exceed the FDIC's maximum coverage, the regional and mid-sized banks surveyed by Wedbush have a median of only 57% and 69% of their total insured deposits, respectively.

And it is on this basis and information that Apple can be said to have come to market with its product at the best possible time, a time when uncertainty prevails in the banking sector. It is a brilliant move, but it may add considerably to the uncertainty in the banking sector if people move their money from banks to Apple or Robinhood.

- What do you think? 🤔

Please note that this is not financial advice.

Great thing and great opportunity especially for $AAPL. Unfortunately it will take a long time before such opportunities come to us. I'm still waiting for an announcement from Apple regarding AI. There I'm afraid they'll miss the train.

Perfect timing, awesome, $AAPL stonks up! 🧐

Be mad at me or not, but Apple is realistically the best company ever

it's good that he launched it especially applu RH I don't trust much I like when someone fills a gap in the market

Apple's new service is great, I'm looking forward to it being in Europe. And the timing is perfect on their brand's part, when else to curry favour than at a time when everyone is scared.